Will Switzerland Adopt Bitcoin Reserve? National Vote To Decide

Switzerland is gearing up to adopt the Bitcoin reserve amidst growing cryptocurrency acceptance fueled by Donald Trump’s progressive policies. Cryptocurrency advocates nationwide propose considering BTC as a reserve asset along with the dollar, euro, and gold. This initiative tends to provide Bitcoin legal recognition in the European country.

As per a recent report, the campaigners have begun collecting 100,000 signatures, triggering a national vote on Bitcoin adoption. This move could potentially pressure the Swiss National Bank (SNB) to reconsider its pessimistic approach to the flagship cryptocurrency.

Switzerland To Vote For Bitcoin Reserve

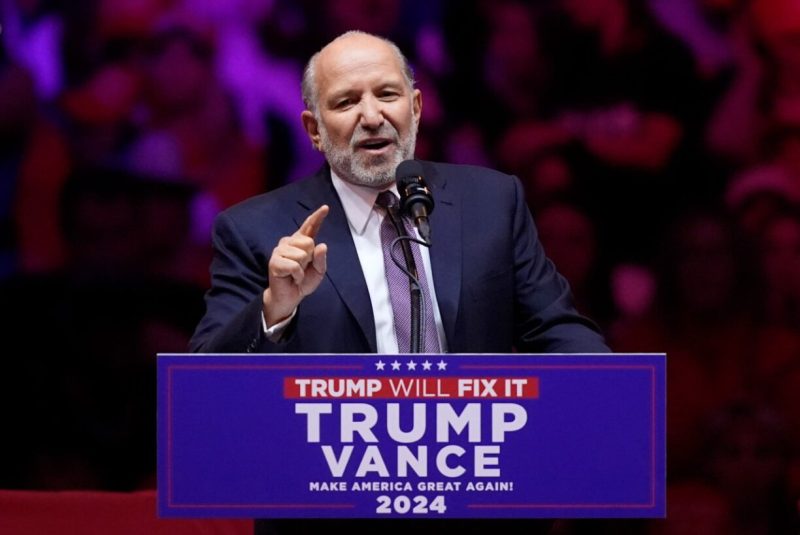

The Swiss Federal Chancellery kicked off the Bitcoin reserve proposal on December 31, 2024, following a failed attempt in October 2021. The motion gained increased attention when Donald Trump, who hails himself the “crypto President,” won the 2024 US election.

The country launched the BTC proposal to amend the Swiss Federal Constitution, facilitating the addition of Bitcoin to the SNB portfolio. The deadline to gather the required signatures is June 30, 2026. After fulfilling the signature count, the proposal would reach the Federal Assembly and then for a public vote.

Commenting on the Swiss public’s positive sentiment towards BTC reserve, crypto enthusiast Rino Borini cited,

People here certainly show more interest and openness for Bitcoin as a store of value than in neighboring countries. It’s like with cash. The Swiss like it for its security and privacy.

BTC To Overpower Centralized Assets

While most of the reserve assets of the central bank are foreign, Switzerland is often dependent on other governments. With the adoption of a BTC reserve, many believe that the decentralized crypto asset could make the country’s financial ecosystem independent.

Nonetheless, the traditionally conservative SNB has expressed skepticism over the Bitcoin reserve proposal despite growing public support for its adoption. Addressing the high volatility of BTC, SNB Chair Martin Schlegel raised concerns over the viability of crypto as payment. He dismissed the proposal in November, describing cryptocurrency as a “niche phenomenon.”

In addition, the largest crypto by market cap constantly shows an unpredictable nature, which remains a major barrier for many to consider it a legitimate asset. UBS economist Alessandro Bee warned that Bitcoin’s high volatility poses risks of SNB’s equity shrinking with market fall. He added, “Over a longer period of time, the SNB’s credibility could suffer.”

Swiss Economy Embraces Future of Finance

Switzerland has been at the forefront of crypto adoption and blockchain advancements. The favorable regulatory framework and advanced technologies of the country have contributed to the growth of the Swiss crypto ecosystem. Also, the nation’s “crypto valley” and blockchain-focused education solidify its position as a global hub for cryptocurrency. Given that the Swiss accept the Bitcoin reserve proposal, it could potentially push the country to become a global leader.

The post Will Switzerland Adopt Bitcoin Reserve? National Vote To Decide appeared first on CoinGape.