Trump’s return to office: four ways he will impact markets – deVere’s Green

Investing.com — The re-election of Donald Trump as the 47th president is predicted to bring substantial changes to financial markets, potentially impacting growth, inflation, and investor strategies. The world’s largest economy is on the brink of a new era, with investors globally being advised to brace for increased market volatility.

Nigel Green, CEO of deVere Group, a leading independent financial advisory and asset management organization, has indicated that Trump’s first day in office could see the signing of at least 100 executive orders. These orders, targeting trade tariffs, deregulation, and defense spending, are expected to shake markets and shape investor expectations in the upcoming months.

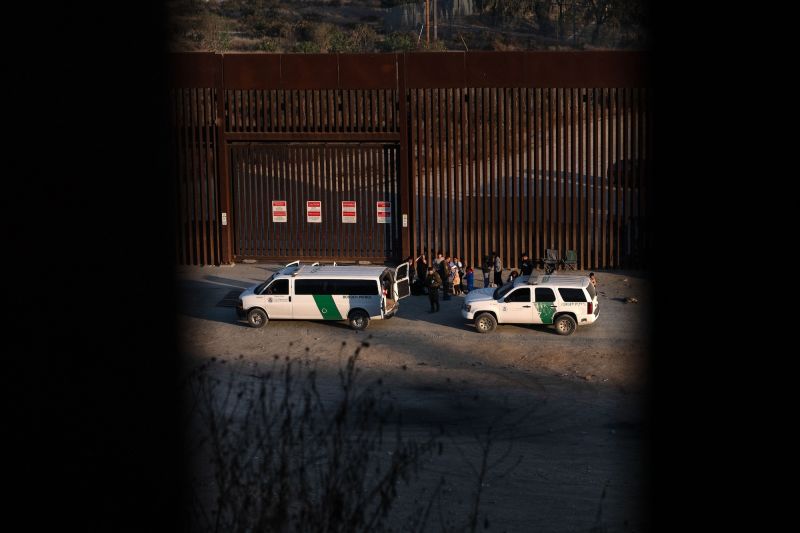

One of Trump’s primary focuses is the reshaping of global trade, starting with tariffs on China, Canada, and Mexico. According to reports, immediate incremental increases of up to 25% on trade with these countries are on the horizon. Trump’s broader tariff plans, which may include duties of up to 20% on all imports, could disrupt supply chains and increase inflation. Green advises investors in multinational corporations and export-heavy sectors to remain vigilant for shifts.

These tariffs could lead to a rise in consumer prices, possibly prompting the Federal Reserve to reassess its current rate path and implement more interest rate hikes. Trump’s ambitious spending plans are expected to further drive inflation, potentially leading to a stricter monetary policy in the future. The dollar is predicted to strengthen in the short term before depreciating as inflationary concerns intensify.

Deregulation is also on Trump’s agenda. Green suggests that the financial, energy, and crypto sectors may experience a revival as Trump plans to roll back many of the restrictions imposed during the Biden administration. Financial services firms, fossil fuel producers, and digital assets like Bitcoin could benefit, causing ripple effects across equities and credit markets.

Defense budgets under Trump are projected to increase, offering new opportunities in the aerospace, cybersecurity, and logistics sectors. This surge in spending could boost defense stocks, while potentially limiting private investment in other sectors.

Safe-haven assets such as gold are likely to gain appeal as Trump’s policies could ignite inflation. China’s shift toward gold and away from the dollar may amplify these trends, potentially leading to record highs in bullion prices.

The next six months are expected to be marked by uncertainty as protectionist policies, deregulation, and inflationary pressures dictate market moves. Strategic diversification and a focus on inflation-resistant assets could be key to protecting portfolios and capitalizing on opportunities in the new economic landscape.

Green concludes by emphasizing the importance of seeking tailored advice to navigate the fast-changing economic landscape and capitalize on the turbulence and emerging opportunities.

This article was generated with the support of AI and reviewed by an editor. For more information see our T&C.