Tech 5: Big Tech Players Release Latest Results, Super Micro Shares Plummet

Wall Street had a mixed week, with indexes rising early in the week but closing lower on Thursday (October 31) due to concerns about rising AI costs and weak economic data.

Despite a weaker-than-expected US jobs report on Friday (November 1), the market opened higher, helped by a strong earnings report from Amazon (NASDAQ:AMZN), which closed a week of earnings reports by showing a massive spike in profits from its cloud and AI businesses.

1. Bitcoin teases all-time high

Bitcoin recovered over the weekend from a dip last Friday, climbing above US$69,000 by Monday (October 28), fueled by growing optimism that Donald Trump will win the upcoming election, as reflected in his favorable odds on betting platforms. This surge widened Bitcoin’s dominance to almost 60 percent, its highest since March 2021, fueled by strong ETF inflows.

The rally continued Tuesday (October 29), pushing Bitcoin past the elusive US$70,000 it had been stuck beneath for weeks to US$71,540. By Wednesday (October 30) it was near its all-time high, hitting US$73,295. This triggered some liquidations, but strong exchange-traded fund inflows suggested continued demand.

Bitcoin performance, October 26 to November 1, 2024.

Chart via CoinGecko.

However, profit-taking on Thursday led to a selloff, driving Bitcoin’s price below US$70,000.

The subsequent 24 hours were marked by extreme volatility, with Bitcoin’s price swinging from US$68,840 to US$71,500 and back to US$69,350 in less than a day. By the end of the trading week, Bitcoin closed at US$69,284, reflecting a 4.39 percent decrease from its highest point this week.

2. Mixed results in tech earnings reports

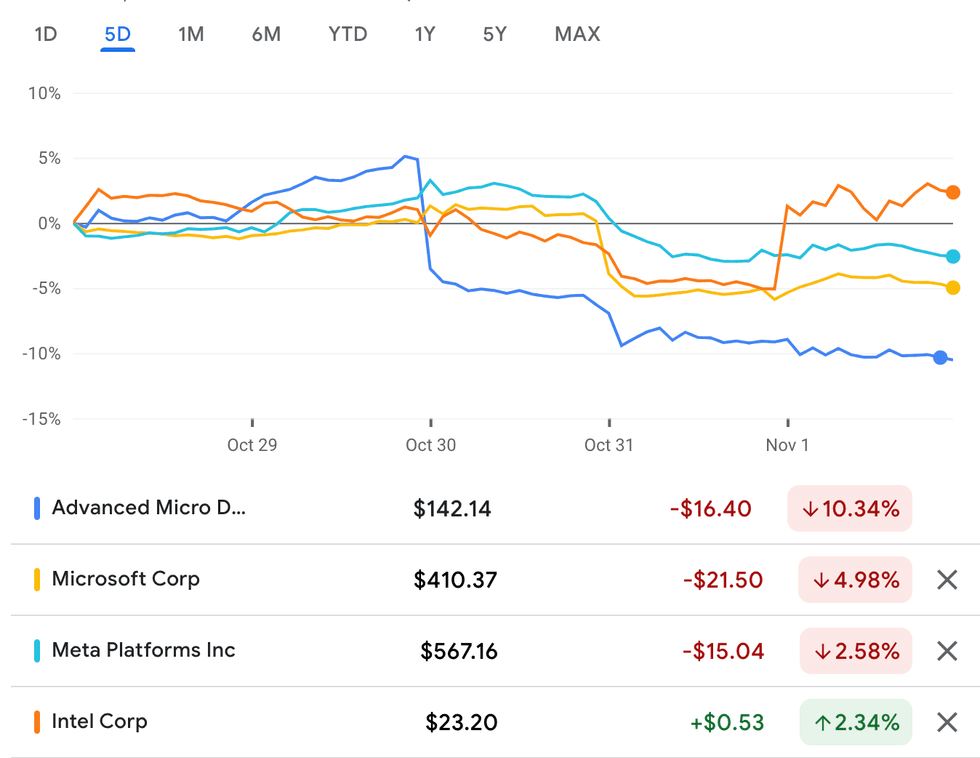

This week’s tech earnings reports were a mixed bag, with most companies facing investor skepticism. AMD (NASDAQ:AMD), the first to report on Tuesday (October 29), saw its share price decline due to a lower-than-expected sales forecast, despite exceeding revenue predictions and demonstrating growth in sales of its data center chips.

Similarly, Microsoft’s (NASDAQ:MSFT) strong revenue growth was overshadowed by concerns about a slowdown in its Azure cloud business. Executives attributed the decrease to capacity constraints rather than decreased demand, but it wasn’t enough to appease investors who sent its share price down by three percent after hours.

AMD, Microsoft, Meta Platforms and Intel performance, October 28 to November 1, 2024.

Chart via Google Finance.

Apple (NASDAQ:AAPL), despite reporting its highest quarterly revenue growth in two years, disappointed investors with its sales forecast, following a lackluster reception to its limited AI feature launch. Apple shares are down 4.54 percent for the week.

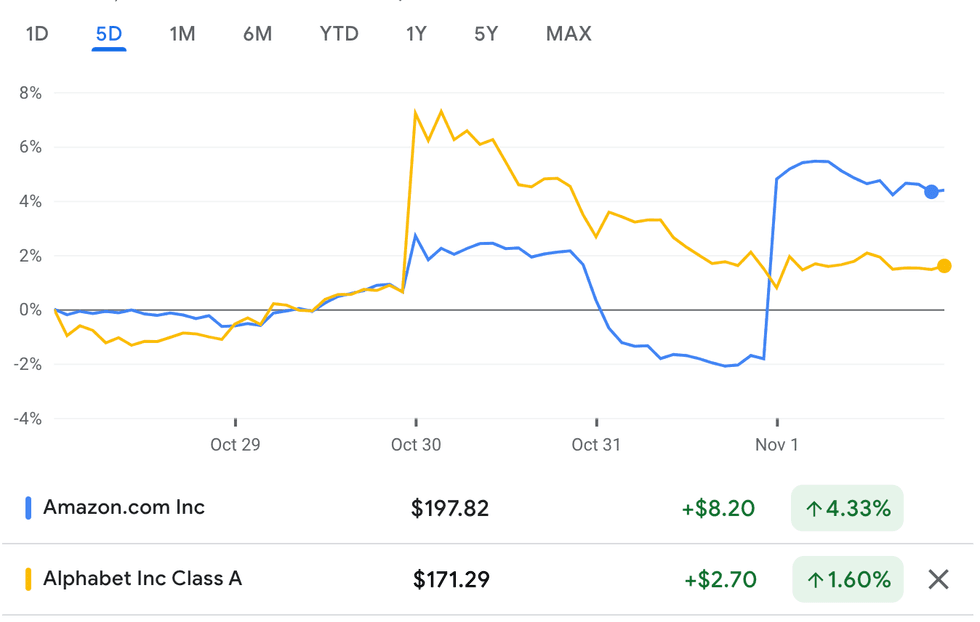

Both Amazon and Alphabet (NASDAQ:GOOGL) reported strong overall revenue growth, with their cloud computing businesses as a key growth driver. Alphabet was trading slightly ahead leading up to the release of its Q3 report, which revealed an increase in total revenue to US$88 billion, 15 percent higher than last year’s Q3 and beating estimates of US$86.44 billion. The primary contributor to Alphabet’s growth was its Google Cloud business, which expanded by 39 percent. This growth was fueled by AI, which attracted new users and increased engagement with existing ones.

Conversely, search ad growth decelerated, decreasing by 12 percent compared to the previous quarter’s 14 percent decline. Capital expenditures, which have set a running rate of around US$13 billion per quarter this year, are set to increase in 2025, although growth will likely be smaller than it was in 2024, which may have eased investors’ worries that spending on AI will eat into the company’s profits.

Amazon and Alphabet performance, October 28 to November 1, 2024.

Chart via Google Finance.

Later, on Thursday evening, Amazon’s Q3 report showed 50 percent growth in Amazon Web Services’ quarterly operating profit to US$10.4 billion. Revenue also increased by 19 percent to US$27.5 billion. Investors appeared unconcerned about Amazon’s significant capital expenditures, sending its shares up 6.75 percent on Friday morning.

This is likely because AWS’s generative AI business is rapidly expanding. Andrew R. Jassy, president and CEO of Amazon, explained during a conference call that AWS’ AI segment is growing at a triple-digit rate, exceeding even AWS’s early growth trajectory.

On the other hand, Meta’s (NASDAQ:META) 4.19 percent share price dip was triggered by plans for increased capital expenditure and anticipated losses in its AI division, highlighting growing investor impatience with the company’s ambitious spending on AI ventures, especially as its cloud business hasn’t generated the profits seen by Amazon, Alphabet and Microsoft to offset these losses.

Finally, after a disastrous performance in Q2, Intel (NASDAQ:INTC) managed to restore some investor confidence. Its Q3 results beat analysts’ expectations, despite reporting a 6 percent decline in quarterly revenue to US$13.28 billion and losses of US$16.6 billion, arising from the company’s ongoing restructuring efforts. The company’s stock is up 2.34 percent for the week.

3. Apple’s week of product launches

Apple had a busy week of product rollouts, starting with the launch of Apple Intelligence on October 28 (Monday). However, the initial release proved underwhelming due to its limited functionality, offering only AI enhancements to Photos and Writing tools. Most highly anticipated features are delayed until December, and users are required to join a waitlist to gain access to them.

Apple also introduced its new line of iMacs featuring M4 chips and built-in Apple Intelligence, which failed to garner enthusiasm. Apple ended the trading day slightly below its opening price.

Tuesday saw the launch of the new Mac mini, a compact 5×5 inch desktop designed for flexibility; the computer is sold as a stand-alone product and is compatible with non-Apple peripherals, allowing consumers to design their own system by adding their preferred display, keyboard and mouse. This product launch resulted in a marginal increase in its share value.

On October 30 (Wednesday), Apple introduced the powerful M4 Pro and M4 Max chips, designed for high-performance users with higher memory bandwidth and more GPU cores than the standard M4. However, in the lead-up to the company’s Q3 earnings report on Thursday, Apple’s share value dipped by over one percent.

Overall, Apple’s stock value has decreased by 4.54 percent this week.

4. Super Micro Computer faces financial turmoil

Shares of Super Micro Computer (NASDAQ:SMCI) are down a whopping 45.5 percent this week after the California-based server maker disclosed that global accounting firm EY had resigned.

The firm cited issues with the company’s financial reporting as the reason for terminating the relationship, saying it had identified issues that raised concerns about the Audit Committee’s representations. The news was reported by Reuters on Wednesday and resulted in a 33 percent drop in Super Micro’s share price.

Super Micro Computer, whose valuation peaked in 2024 at US$118.81 mid-March and was up over 65 percent year-to-date before this story broke, disagrees with the firm’s findings; however, investors seem to be airing on the side of caution, as this latest development adds to a series of unanswered questions surrounding the company’s financial reporting.

Super Micro delayed filing its annual report in late August to assess its internal controls over financial reporting after Hindenburg Research made claims of possible account manipulation. Super Micro then hired a special committee to investigate the matter, which EY said it could “no longer rely on” in a recent filing with the US Securities and Exchange Commission. The US Department of Justice reportedly also began an investigation into the company in September, according to a report by the Wall Street Journal.

5. Google Cloud gains a new partner

Google Cloud announced a partnership with web3 infrastructure provider MANTRA on Tuesday.

Under the terms of the deal, Google Cloud will serve as the primary validator and infrastructure provider for the MANTRA Chain, a Layer-1 blockchain designed to facilitate the tokenization of real-world assets (RWAs). MANTRA Chain will be integrated into Google Cloud’s Web3 portal, giving developers the tools they need to build RWA solutions on the platform. The partnership aims to drive the adoption of RWAs in industries like finance and real estate.

Furthermore, MANTRA and Google Cloud are launching MANTRA Incubator in 2025, an accelerator program to support real-world asset tokenization projects with resources and expertise.

This agreement presents a potentially lucrative revenue stream for Google Cloud and strengthens the company’s presence in the Web3 space. As the primary validator for MANTRA, Google Cloud will earn rewards for validating transactions and securing the network. As the MANTRA Chain grows and handles more transactions, Google Cloud’s revenue will likely increase.

This collaboration marks a significant step for both companies, highlighting the growing interest and potential of blockchain technology in transforming traditional industries.

Securities Disclosure: I, Meagen Seatter, hold no direct investment interest in any company mentioned in this article.