Take Five: Crypto bulls and euro bears

(Reuters) – Chip behemoth Nvidia (NASDAQ:NVDA) is reporting quarterly results and global PMI data is rolling in as markets continue to digest the fallout from Donald Trump’s U.S. presidential election win, with bitcoin and the euro taking centre-stage.

Here’s a look at the week ahead for markets from Rae Wee in Singapore, Ira Iosebashvili in New York, Sam Indyk, Naomi Rovnick and Amanda Cooper in London.

1/CHIP, CHIP, HURRAY

The U.S. earnings season is coming to a close with third quarter results from chipmaker Nvidia, a bellwether for the artificial intelligence craze that has boosted stocks this year.

Nvidia’s chips are seen as the gold standard in the AI-space and its shares are up nearly 200% this year, a gain that saw it dethrone Apple (NASDAQ:AAPL) as the world’s most valuable company in October. The chipmaker’s hefty weighting in the S&P 500 has helped drive the index to record highs in 2024.

But Nvidia’s blistering multi-year run has also raised the bar for earnings outperformance – a slip-up could fuel worries that the market’s AI hopes have outstripped reality.

Analysts see Nvidia increasing third-quarter revenue by over 80% to $32.9 billion when it reports its results on Nov. 20, LSEG data showed earlier this month.

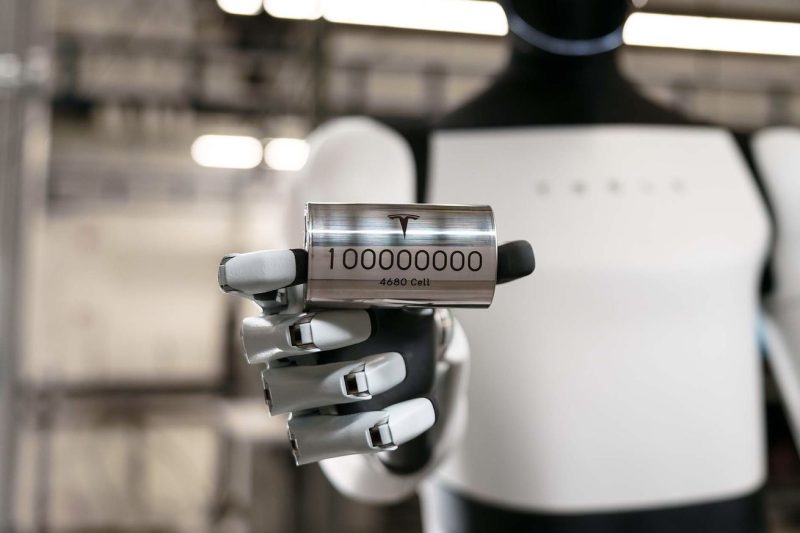

2/ A $100,000 QUESTION

Trump’s win has unleashed a stampede of crypto bulls intent on driving bitcoin to the moon. The price has risen 30% since the Nov. 5 election day and, having topped $90,000 for the first time on record, is showing no signs of stopping.

The entire crypto market has surpassed $3 trillion for the first time on record. Bitcoin and co are worth about as much as Elon Musk’s Tesla (NASDAQ:TSLA), Facebook (NASDAQ:META) parent Meta and Warren Buffett’s Berkshire Hathaway (NYSE:BRKa) put together.

The promise of light-touch U.S. regulation means investors can’t get enough of bitcoin right now. Flows into exchange-traded funds have rocketed in recent days. LSEG data shows the largest ETFs tracked by Reuters took in a net $3.5 billion in the week to Nov. 14, the most since March 15. There seems to be little standing in the way a six-figure bitcoin price tag.

3/A QUESTION OF PARITY

Threats of Trump tariffs are heightening fears about the weak euro area economy and the common currency has been flailing. But how low could it go?

At around $1.054, the euro has slumped about 5% from more than one-year highs in September. Some analysts now expect it to fall to parity with the dollar.

The last ZEW Institute survey showed German investor confidence is gloomy while traders see a one in five chance the European Central Bank will cut rates by 50 basis points next month. Breakdown German GDP data due out on Nov 22 might give more hints.

Look out for silver linings, though. A weaker euro boosts exporters and faster rate cuts could juice up bank lending and business activity.

4/ AT YOUR SERVICE

Friday’s preliminary survey data on business activity will sketch a picture of the global economy before Trump returns to the White House in January.

PMIs from Europe and the U.S. will likely confirm that global manufacturing activity remains stuck in a downturn, while the services sector soldiers ahead.

Each country is facing its own unique uncertainties. Germany’s flagging economy is on the cusp of new elections, Britain’s employers are bracing for a rise in social security contributions expected to hit hiring and costs. But it’s Trump’s re-election that is dominating the outlook.

The survey could give early indications on how U.S. companies are responding to the threat of Trump’s proposed import tariffs – possibly boosting inventories before tariffs kick in – a data point that will be closely watched by markets going forward.

5/ THE RUPIAH CONUNDRUM Indonesia’s central bank will decide on interest rates on Wednesday and it is a toss up whether the policy makers will ease rates or stand pat.

Slowing inflation, disappointing growth and the Fed’s recent rate cut cement the case for further easing. But the weakening rupiah, currently languishing near three-month lows and down more than 4% from this year’s peak, is putting a spanner in the works for a central bank whose main mandate is to maintain currency stability, even though much of that might be driven by the strong dollar.

Elsewhere in emerging markets, rate decisions in Turkey and South Africa are due on Thursday. South African policymakers are expected to deliver a 25 basis point cut at their final meeting of the year. Upward revisions to inflation forecasts in Turkey make chances of any near-term easing unlikely.

(Graphics by Pasit Kongkunakornkul, Vineet Sachdev, Kripa Jayaram, Sumanta Sen and Prinz Magtulis; compiled by Karin Strohecker; editing by Philippa Fletcher)