Oil and Gas Price Update: Q2 2025 in Review

In the face of geopolitical strife oil and gas prices were able to register moderate gains through the first half of 2025, although the second half of the year is likely to be punctuated with continued unrest and supply chain fragility.

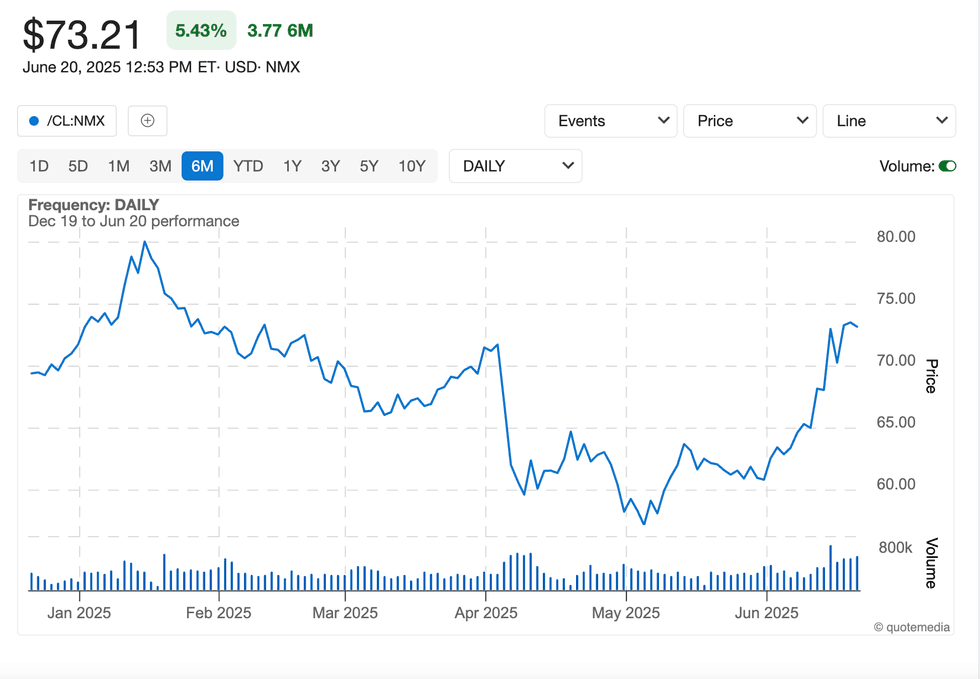

Oil benchmarks ended the first quarter slightly off their 2025 start positions, with Brent crude coming in at US$76.08 per barrel and West Texas Intermediate (WT) hitting US$72.87 per barrel before headwinds began sending values lower.

In early May, both benchmarks dropped sharply, Brent slipping nearly 6 percent to US$60.48 while WTI fell to US$57.42, a near two year low. The decline was driven by a combination of weak demand and rising supply as OPEC+ signaled plans to boost production in July, adding to existing oversupply concerns after a surge in global inventories.

Additionally, signs of cooling economic growth in China and renewed trade war anxiety between the US and China further pressured market sentiment. As concerns over a trade war and energy tariffs subsided, prices were able to rally through the rest of May and June to hold in the US$78.42 and US$77.19 range for Brent and WTI, respectively.

Now approaching the year-to-date high level global strife and potential supply constraints are adding support.

During an International Energy Agency (IEA) presentation, Fatih Birol, executive director of the IEA, addressed the current challenges in the global landscape, particularly the mounting conflict in the Middle East.

“The situation is still unfolding, and there are many uncertainties (about) how and if it is going to have structural impacts on the oil and energy markets,” he said, noting that the IEA would not be speculating.

However, Birol did underscore Iran’s position in the global oil market.

“According to our oil market report, currently, Iran produces about 4.8 million barrels per day (mb/d) of crude, condensate and NGL and exports are around 1.8 mb/d of crude oil and 800,000 b/d of products,” he said. “For now, when we look at the markets, we do not see a major supply disruption.”

WTI price performance, December 19, 2024, to June 19, 2025.

Demand expected to trend lower

Although the regional conflicts have infused uncertainty into markets, longer term fundamentals like supply and demand trends are painting a volatile picture.

As noted in the IEA’s recently released Oil 2025: Analysis and Forecast to 2030 report, supply is likely to outpace demand this year and next.

“Our expectations for demand growth are much less than the supply growth,” explained Birol. “We expect demand this year to grow about 700,000 barrels per day, whereas the supply growth we expect is more than double, about 1.8 mb/d.”

More broadly, the IEA report forecasts global oil demand to rise by 2.5 mb/d between 2024 and 2030, reaching 105.5 mb/d by decade’s end.

However, most of that growth will occur early in the period, with gains slowing after 2026 and dipping slightly by 2030. Weaker economic growth and a shift away from oil use in transportation and power generation are the main factors behind the long term slowdown.

Much of the demand forecast is dominated by powerhouse countries US and China which account for 20 mb/d and 13 mb/d respectively, comprising 33 percent of global demand. As such changes to either country’s market can have a large sale effect across the sector.

“When we look at the supply side, global oil production in the last 10 years or so, more than 90 percent of the growth came from the United States. And on the demand side, more than 60 percent of the global oil demand growth came from China,” said Birol. “This came almost parallel and simultaneously.”

Now, again working in tandem, US oil production growth is slowing due to economic and geological factors, while China’s oil demand is also losing momentum as its economy shifts and its transportation sector evolves according to Birol.

Economic headwinds could impede demand

Economic concerns are also an issue across the globe, and historically gross domestic product is heavily correlated to oil demand.

Global GDP is expected to grow at an average annual rate of 3 percent through 2030, but that growth is uneven. OECD countries will see slower expansion at 1.8 percent, while non-OECD nations are projected to grow at 3.9 percent.

This global pace falls short of the 2010s trend, with factors like aging populations and reduced globalization weighing on long-term growth and trade.

China’s slowdown is particularly sharp, with its annual GDP growth nearly four percentage points lower than in the previous decade due to structural economic and demographic challenges.

While GDP remains a key driver of oil demand, its influence is fading.

Oil consumption is set to rise in 2025 and 2026 in line with economic growth, but from 2027 onward, demand is expected to plateau and then slightly decline. That shift is being driven by the growing use of alternatives in transportation and power generation.

Supply growth steady through 2030

Despite a projected decline in US output, the IEA expects oil supply to remain robust in other regions.

“We expect between now and 2030, about 5 mb/d of additional production capacity,” the CEO of the IEA remarked.

“A big chunk of it is coming from what we call the American quintet, namely US, Brazil, Canada, Guyana and Argentina. These five countries will bring a lot of oil to the markets.”

Providing a more detailed look at the supply picture, Toril Bosoni, head of oil industry and markets division at the IEA reiterated that global oil supply is on track to outpace demand through 2030, offering a stabilizing force in an otherwise uncertain energy landscape.

As Bosoni explained, supply is expected to grow by 1.8 mb/d in 2025, a trend largely being driven by non-OPEC+ countries, particularly in the Americas.

Additionally, natural gas liquids are playing an increasingly important role in this growth, as US shale production shifts focus and Saudi Arabia expands its gas-linked output.

“Looking into the next year, from 2025 until 2030 we can see that the United States is still a big source of supply growth, but the pace of growth is much slower than what we have seen for the past decade, and it’s largely driven by gas liquids, as activity in the shale patch is slowing down and getting more into the gas side,” said Bosoni.

IEA data projects total global oil supply capacity to rise by about 5 mb/d by the end of the decade. Most of this growth will come from outside OPEC, and is closely aligned with rising demand for petrochemical feedstocks, such as ethane and naphtha, which bypass the traditional refining process.

However, traditional crude supply is expected to see only modest gains unless additional projects—many of which have yet to reach a final investment decision—move forward.

The refining sector, meanwhile, may face increasing pressure as fuel demand flattens and high-cost plants, particularly in Europe and parts of Asia, become less competitive.

Despite slowing demand, the coming years are expected to bring ample supply—helping to buffer against geopolitical shocks and lending some reassurance to markets amid broader global economic headwinds, Bosoni added.

Natural gas market remains positive

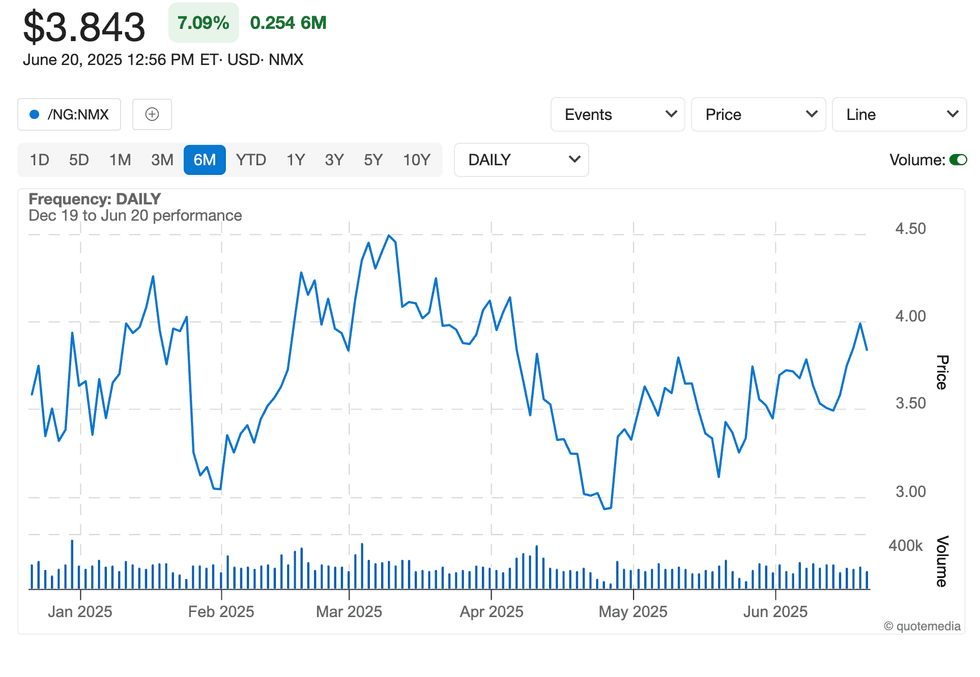

The natural gas markets faced heightened volatility through H12025, driven by several key factors. A milder-than-expected winter in major consuming regions like the US and Europe led to weaker heating demand, pushing prices lower early in the year.

However, Q2 saw a rebound as unseasonably hot weather in Asia and parts of North America boosted cooling demand. Supply disruptions, including maintenance delays at major LNG export facilities in the U.S. and Australia, further tightened markets.

Starting the year at US$3.65 per metric million British thermal units, prices rose to a H1 high of US$4.49 in March, before falling to a H1 low of US$2.99 in late April.

Geopolitical tensions, particularly instability in the Middle East affecting shipping routes, added upward pressure through May and June pushing prices back above US$4.00 by mid-June.

Natural gas price performance, December 19, 2024, to June 19, 2025.

Natural gas supply growth to outperform oil

Natural gas liquids (NGLs) are emerging as a major driver of global oil supply growth through the end of the decade, with output forecast to rise by 2 mb/d to 15.5 mb/d by 2030, according to the IEA.

Much of this increase will come from North America and the Middle East, which will account for nearly half of all global supply gains over the next five years.

As noted in the report, the surge is being fueled by rising production from lighter, gas-rich fields and unconventional reserves.

The US, already the top NGL producer, will increase output from 6.9 mb/d in 2024 to 7.8 mb/d in 2030. Saudi Arabia is set to boost production from 1.4 mb/d to 2 mb/d over the same timeframe, while Canada will add 300,000 b/d.

This expanding supply is feeding demand for petrochemical feedstocks like ethane, propane and butane, vital in the production of everything from plastics to clean cooking fuel.

Ethane demand alone is expected to climb by 610,000 b/d to 5.2 mb/d by 2030, while LPG consumption is forecast to rise by 1.3 mb/d to 11.8 mb/d. Asia—led by China and India—will account for more than 65 percent of global LPG demand growth.

The rise of NGLs also poses a long-term challenge to traditional refining, as many of these products bypass refining altogether. With petrochemical demand outpacing that for transportation fuels, refiners may face margin pressure and shutdown risks, particularly in high-cost regions like Europe and parts of Asia.

Despite slower year-over-year growth, the IEA sees NGLs playing an increasingly vital role in shaping the future energy mix. This is supported by the 216 percent increase in production the NGL sector has seen over the past decade.

“From 2014 to 2024, global NGLs production grew by 4.3 mb/d to 13.6 mb/d. NGLs will rise by a further 2.0 mb/d to 15.5 mb/d in 2030, with average annual growth slowing to 2.3 percent over the forecast period, from 3.9 percent during the previous decade,” the report read.

Much of the IEA’s outlook falls inline with the short term price projections the US Energy Information Administration released in May, which forecast the average price for Brent crude to be US$66 in 2025 and US$59 in 2026. While natural gas prices will rise from an average US$4.10 in 2025 to US$4.80 in 2026.

Securities Disclosure: I, Georgia Williams, hold no direct investment interest in any company mentioned in this article.