Master a Different Kind of Trading with Big Wave Trading

Premium Rooms on StockTwits gives you unprecedented access to exclusive content, concepts, and analysis from leading minds in business and finance. Joshua Hayes of Big Wave Trading is one of those leading minds on the Premium Rooms platform.

Below is an introduction to the unique style of investing you’ll find in Joshua’s Big Wave Trading Premium Room on StockTwits.

At Big Wave Trading, I approach the market in a rational and logical manner. I don’t post movements at every minute of every hour, nor do I make things overly complex. Simplicity is the ultimate sophistication.

Instead, I focus on a tried-and-true End-of-Day methodology. As the name implies, this long-term and momentum-based method looks at stocks’ performances after the closing bell and allows traders to reap high rewards and low risks by setting up trades exactly as I set them up for execution the next market day. This doesn’t require following the markets at every waking moment. In fact, it requires as little as 15 minutes out of your day for high reward, low risk, and comparatively hands-off trading.

These longer-term trades are based on the principles of the Scientific Method and Game Theory. Couple this disciplined and logical trading methodology with my 20-plus years of full-time experience in the markets and you have the proven data and knowledge you need to make wise, calculated investment decisions. I provide the entry and exit points based on my research and back-tested data that allows you to select and setup your trades exactly as I am setting them up for execution in my personal brokerage accounts the next trading session.

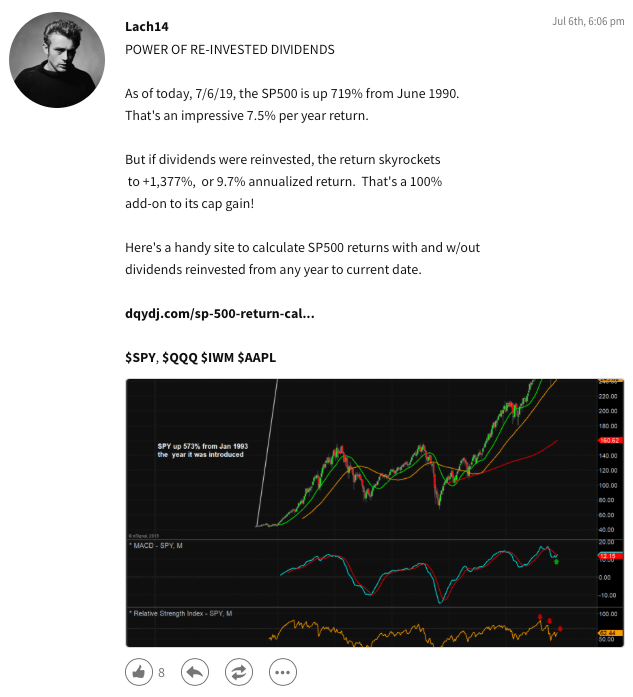

A sample of the data you’ll find on Big Wave Trading, now on StockTwits.

Big Wave Trading is not just a community for making money; it’s also a Room to foster your financial education. As someone who spent years deep in the world of NYC finance, only to escape to the beautiful island of Maui, I offer a wealth of information and education to help further your knowledge on trading and investing from a 4,900 mile view. I trade the way I surf: with safety and intelligence. When I am in doubt, I do not go out. When the geometric formation of the wave indicates that the wave will be a close out, I cut my losses and do not take the wave. Doesn’t it make sense to trust your trading in the hands of someone that treats their portfolio with the same care that they do when surfing large and dangerous waves in volatile conditions? It does if you ask me. And ask me you can as I’m always available in my Premium Room to help guide you as you learn and earn. Just tag me in your post and you’ll get an immediate response.

By joining Big Wave Trading, you’ll leverage my proven methodology and decades of experience to increase your portfolio without spending oodles of time research, scanning, and finding trades. I do all of that work for you. I scan, research, and then place in front of you the best trade setups for the next market day Sometimes the best trade is no trade. It happens. However, in today’s markets, that is not the norm, as there is always something moving due to an important catalyst event. Most importantly, you’ll have fun while doing so and be able to spend the vast majority of your day doing what you love with the people you love. I look forward to seeing you inside the barrel at Big Wave Trading.

PS: As an added bonus, you’ll also receive a few of my daily SPY option directional trades of the day and a Monday and Friday detailed video lesson — usually reserved for members of my website — with detailed explanation of how these instruments should be traded and how I am trading them on a daily basis. I’ll see you the lineup. Surf’s up!

Aloha.

-Joshua Hayes

To follow Joshua Hayes’ trades, visit Big Wave Trading on StockTwits to subscribe today. You’ll only find this level of insight from Joshua and others on Premium Rooms, ideas that matter on a platform you trust.

Master a Different Kind of Trading with Big Wave Trading was originally published in The Stocktwits Blog on Medium, where people are continuing the conversation by highlighting and responding to this story.