Has AAVE Price Hit Overbought Levels After a 30% Weekly Surge?

AAVE price surged 9% during the U.S. trading session on Monday, climbing among the top gainers according to Coinmarketcap. With a six-day rally, the altcoin breaks out of a two-year accumulation trend and retests at $180, a level last recorded in late April 2022. However, is the recovery sustainable?

Is AAVE Price Entering Overbought Territory After a 30% Weekly Rally?

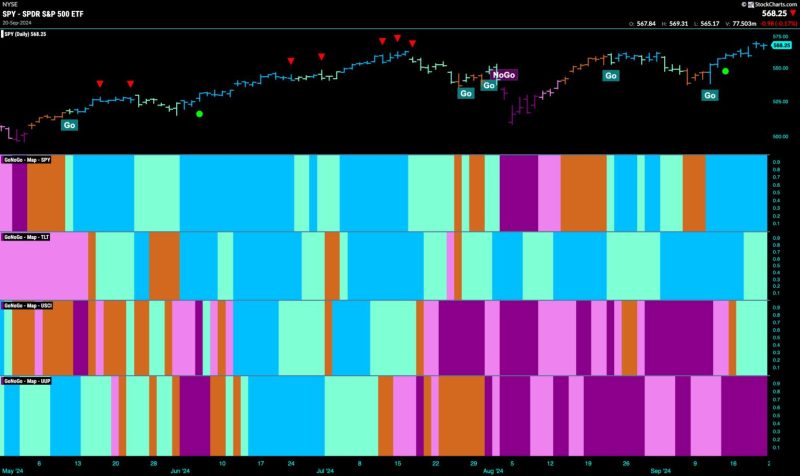

The AAVE daily chart showed a high momentum price rally from $134 to $176 last week, accounting for a 32% growth. The bullish recovery backed by substantial volume gave a decisive breakout of $153 resistance, concluding a 2-year accumulation trend.

An analysis of the weekly time frame chart shows the recovery is contributing to the formation of a well-known reversal pattern called the Rounding Pattern. The chart setup displays a saucer shape and provides a stable transition from a prevailing downtrend to an accumulation stage and then high momentum recovery.

With sustained buying, the AAVE price could surge 12% to challenge the $200 psychological resistance, followed by an extended rally to $260.

AAVE/USDT – 1d Chart

According to Santiment data, whale wallets holding between 1 million to 10 million AAVE have been on a buying spree since early August 2024, with their accumulation now reaching a total of $4.2 million in AAVE tokens. This significant accumulation could potentially impact the AAVE market dynamics, bolstering its ongoing recovery.

Supply Distribution | Santiment

On the contrary note, the AAVE price has stretched far from its fast-moving 20-and-50-day exponential moving average, which is unstable and typically drives a bearish pullback.

Another technical indicator, the Average Directional Index (ADX) surged to 35%, indicating the buyers could soon hit exhaustion and fail to sustain higher levels.

Furthermore, the 30-day MVRV ratio surged by 23%, signaling that short-term traders are currently in profit. Historically, such elevated levels have coincided with Aave price peaks, as speculative traders often flood the market, capitalizing on short-term gains.

30-day MVRV – Santiment

Therefore, as no trends remained the same, the AAVE price soon witnessed a temporary pullback potential to 20-days to recuperate the bullish momentum for the next leap.

The post Has AAVE Price Hit Overbought Levels After a 30% Weekly Surge? appeared first on CoinGape.