Crypto Market Update: US$1.5B Bullish Crypto Bets Liquidated in Sharpest Drop Since March

Here’s a quick recap of the crypto landscape for Monday (September 22) as of 9:00 a.m. UTC.

Get the latest insights on Bitcoin, Ethereum and altcoins, along with a round-up of key cryptocurrency market news.

Bitcoin and Ethereum price update

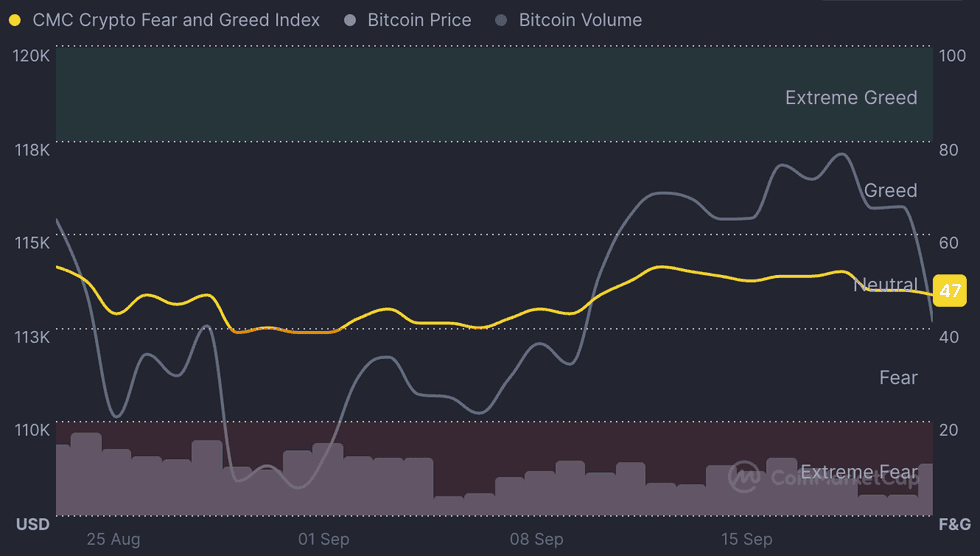

Bitcoin (BTC) was priced at US$112,653, a 2.7 percent decrease in 24 hours. Its lowest valuation of the day was US$112,293 after an earlier price peak of US$115,775.

Bitcoin price performance, September 22, 2025.

Chart via TradingView

Bitcoin dropped to US$112,000 range after falling below a key support level, triggering the year’s largest long-liquidation event — over US$1.7 billion in leveraged long positions were closed. The decline came even as some investor accumulation showed through surging exchange outflows and rising longs on platforms like Bitfinex, which added pressure from both sides.

Ether (ETH) was trading at US$4,181.86, down by 6.4 percent. Its lowest valuation as of Monday was US$4,145.53, while the cryptocurrency’s highest was US$4,497.46.

Altcoin price update

- Solana (SOL) was priced at US$221.91, a decrease of 7.5 percent over the last 24 hours. Its lowest valuation of the day was US$220.28, while its highest valuation was US$240.05.

- XRP was trading for US$2.82, down by 5.5 percent in the past 24 hours. Its lowest valuation of the day was US$2.78, while its highest was US$2.99.

- SUI (Sui) was valued at US$3.32, trading at its lowest valuation of the day and down by 8.2 percent over the past 24 hours. Its highest price point on Monday was US$3.67.

- Cardano (ADA) was priced at US$0.8246, down by 7.0 percent over 24 hours. Its lowest value of the day was US$0.813, while its highest value was US$0.8893.

Last week’s crypto recap

Last week saw crypto markets consolidate into a tight range.

BTC largely held just below its all-time high of US$118,000), trading around US$116,000 to US$117.000 most of the week. Meanwhile, ETH quietly rallied: large spot-ETH ETF inflows of nearly US$2.13 billion on September 19 alone pushed ETH briefly above US$4,500.

Meanwhile, the Fed’s expected 25 bps rate cut on September 17 produced only a muted “sell-the-news” reaction.

BTC briefly surged above US.$117,000 on the news. Moreover, investors poured more money into crypto funds: about US$1.9 billion flowed into exchange-traded crypto products last week, translating roughly US$977 million into BTC ETFs and US$772 million into ETH funds. This brought BTC ETF inflows hovering around US$3.9 billion over the past four weeks.

Recent policy developments last week also broadened crypto’s institutional access. The SEC approved the first spot ETFs for altcoins, as REX-Osprey XRP ETF (CBOE:XRPR) and REX-Osprey DOGE ETF (CBOE:DOJE). For stablecoins, Tether launched a new US-compliant dollar token (“USA₮”) under the GENIUS Act.

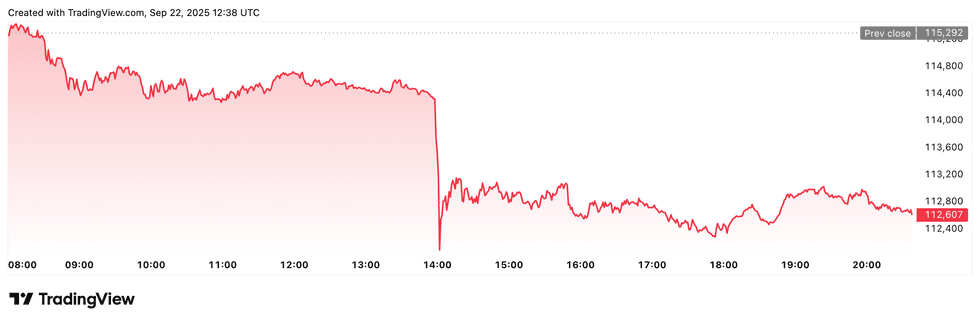

Fear and Greed Index snapshot

Chart via CoinMarketCap

CMC’s Crypto Fear & Greed Index remained firmly in neutral territory over the past week. The tracker shows readings oscillating around 50: for instance, it registered 53 on September 17, then dipped to 48 by September 20 and 49 by September 21.

Currently, the index remains registered on neutral territory at 47. The past week’s negative funding rates on perpetual futures and long/short ratios suggest slight caution, but strong ETF inflows and recent whale buying show underlying bullish conviction from investors.

Things to look out for

Over the course of this week, traders will be keeping a very close eye on the Federal Reserve and the tone at the Fed, combined with how recent economic data compares to expectations.

Federal Reserve Chair Jerome Powell will be speaking, after the policy-outlook statement. If the upcoming economic data disappoints, analysts say that there is a risk that BTC could retest support in the low US$112,000 range.

Meanwhile, a dovish pivot could rapidly reignite inflows into ETFs and “riskier” assets, lifting all boats including volatile altcoins.

Furthermore, the report on US existing home sales data is also due on Wednesday (September 23). The data gives insight into the state of the housing market, which is one of the key components of consumer spending and overall economic health.

Today’s crypto news to know

Bullish crypto bets unwind as US$1.5 billion liquidated

Crypto markets endured their steepest shakeout in months after more than US$1.5 billion in leveraged long positions were wiped out on Monday (September 22), according to Coinglass.

Ether bore the brunt of the rout, plunging as much as 9 percent to US$4,075, while Bitcoin briefly slipped 3 percent to US$111,998. The wave marked the largest round of liquidations since March 27, with more than 407,000 traders seeing positions erased in just 24 hours.

Analysts pointed to fading demand from digital-asset treasury firms, whose stock retreats signaled waning appetite for large-scale token hoarding. Funding rates for Ether futures have also now turned negative, a sign that short sellers are paying to maintain bearish bets.

Overall, crypto market capitalization dropped below US$4 trillion, while gold prices surged to fresh records near US$3,720 an ounce.

Metaplanet climbs to fifth-largest corporate Bitcoin holder

Tokyo-based Metaplanet has cemented itself as a heavyweight in corporate crypto holdings, announcing the purchase of 5,419 BTC worth US$633 million.

The acquisition boosts its total stash to 25,555 BTC valued at nearly US$3 billion, making it the fifth-largest corporate Bitcoin treasury, according to BitcoinTreasuries.net.

The buy came at an average of about US$117,000 per Bitcoin, leaving the firm temporarily down almost 4 percent as spot prices hovered closer to US$112,500.

Despite the purchase, Metaplanet’s stock has struggled to keep pace. The company’s shares have tumbled by more than 30 PERCENT over the past month even as shares rose modestly this week.

London prepares for US$7 billion Bitcoin fraud trial

The UK is bracing for one of its most significant crypto trials as Zhimin Qian, a Chinese national accused of orchestrating a US$7 billion Ponzi-style fraud, faces charges in London starting September 29.

Qian allegedly ran Tianjin Lantian Gerui Electronic Technology, a scheme that lured nearly 130,000 investors in China with promises of triple-digit returns between 2014 and 2017.

After China’s crypto ban, she fled to Britain and converted proceeds into Bitcoin, some of which were later seized in UK money laundering probes linked to her associate Jian Wen, already convicted in 2024.

Prosecutors have avoided direct fraud charges, instead focusing on offenses tied to the possession and transfer of illicit cryptocurrency.

Securities Disclosure: I, Giann Liguid, hold no direct investment interest in any company mentioned in this article.

Securities Disclosure: I, Meagen Seatter, hold no direct investment interest in any company mentioned in this article.