Crypto Market Update: Trump’s Tariff Threats Trigger US$875 Million Crypto Liquidation Wave

Here’s a quick recap of the crypto landscape for Monday (January 19) as of 9:00 a.m. UTC.

Get the latest insights on Bitcoin, Ether and altcoins, along with a round-up of key cryptocurrency market news.

Bitcoin and Ether price update

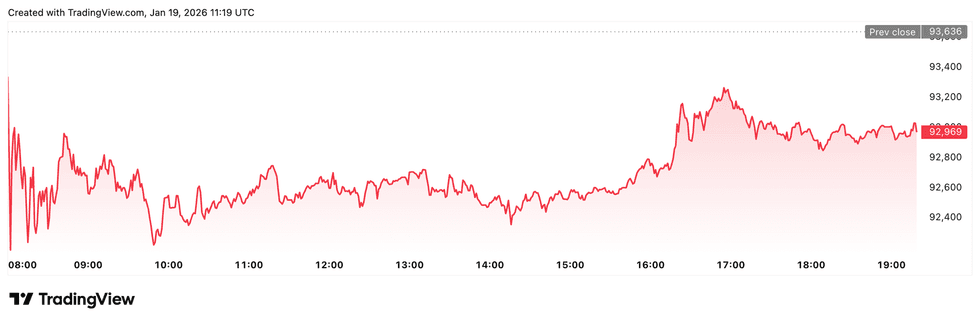

Bitcoin (BTC) was priced at US$93,135.95, down by 2.2 percent over 24 hours.

Bitcoin price performance, January 19, 2025.

Chart via TradingView

Ether (ETH) was priced at US$3,209.04, down by 3 percent over the last 24 hours.

Altcoin price update

- XRP (XRP) was priced at US$1.98, down by 3.8 percent over 24 hours.

- Solana (SOL) was trading at US$133.82, down by 6.1 percent over 24 hours.

Today’s crypto news to know

Tariff shock rattles crypto as Trump targets Europe

Crypto markets sold off sharply after President Donald Trump said the US would impose escalating tariffs on eight European countries in a dispute tied to Greenland, triggering a rapid risk-off move.

According to derivatives data, roughly US$875 million in leveraged crypto positions were liquidated within 24 hours, which was further amplified by thin holiday liquidity.

Bitcoin slid about 3 percent to near US$92,000, with most forced unwinds coming from bullish bets caught wrong-footed by the geopolitical jolt.

European leaders signaled retaliation, adding to broader market uncertainty across equities, FX, and digital assets.

The proposed tariffs would start at 10 percent in February and rise to 25 percent by June.

Saylor hints at more bitcoin buys after billion-dollar week

Strategy (NASDAQ:MSTR) chair Michael Saylor is again fueling speculation of another bitcoin purchase just days after the company disclosed a $1.25 billion addition to its holdings.

In a weekend post, Saylor shared a familiar chart tracking Strategy’s past buys, a signal he has repeatedly used ahead of formal announcements.

The company has already added nearly 15,000 BTC since the start of the year, bringing total holdings above 687,000 bitcoin. Those coins were accumulated at an average price in the mid-US$75,000 range.

Still, Strategy’s equity has lagged as investors weigh the risks of heavy leverage and ongoing capital raises. The firm continues to rely on instruments like convertible notes to fund purchases without immediate cash strain.

Dormant bitcoin whale cashes out after 12 years

One of Bitcoin’s long-silent early holders has resurfaced, selling a large portion of coins accumulated in 2012 and locking in a staggering gain.

Blockchain data shows the wallet sold roughly 2,500 BTC at prices above US$100,000, turning an original outlay of just over US$300 per coin into hundreds of millions of dollars.

The realized return exceeds 31,000 percent, making it one of the most profitable long-term exits in Bitcoin’s history.

Securities Disclosure: I, Meagen Seatter, hold no direct investment interest in any company mentioned in this article.

Securities Disclosure: I, Giann Liguid, hold no direct investment interest in any company mentioned in this article.