Crypto Market Update: Senate Democrats Demand Trump Envoy Explain Undivested Crypto Stakes

Here’s a quick recap of the crypto landscape for Wednesday (October 22) as of 9:00 a.m. UTC.

Get the latest insights on Bitcoin, Ether and altcoins, along with a round-up of key cryptocurrency market news.

Bitcoin and Ether price update

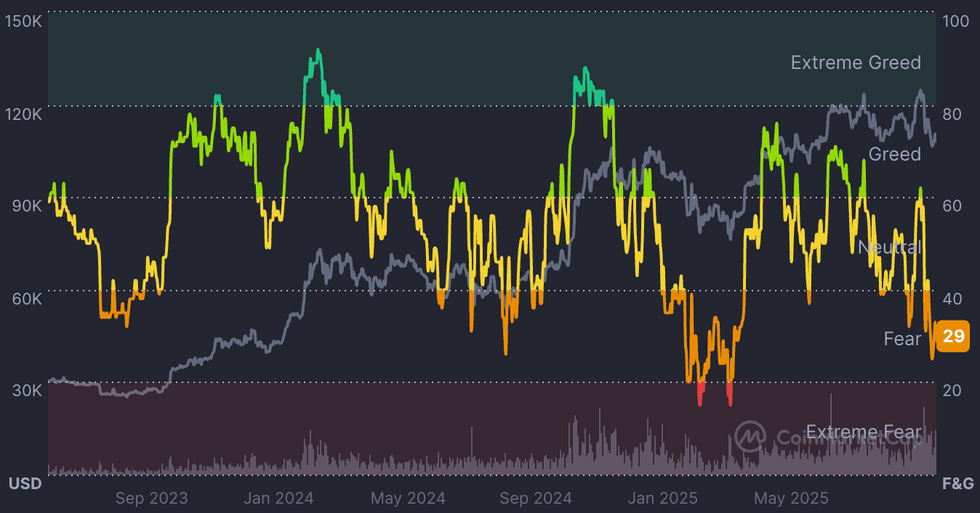

Bitcoin (BTC) was priced at US$108,323, a 1 percent decrease in 24 hours. Its lowest valuation of the day was US$107,393, and its highest was US$113,804.

Bitcoin price performance, October 22, 2025.

Chart via TradingView

Bitwise Chief Investment Officer Matt Hougan believes gold’s explosive performance this year could offer a glimpse of what lies ahead for Bitcoin, arguing that the world’s top cryptocurrency may be preparing for a similar structural breakout once its remaining pool of sellers runs dry.

Gold has surged roughly 57 percent in 2025, powered largely by sustained central bank accumulation. Bitcoin, meanwhile, has traded in a relatively narrow range between US$108,000 and US$112,000. According to Hougan, the comparison between the two assets provides a potential roadmap for their trajectory going into next year.

“Don’t look at gold’s meteoric rise with envy. Look at it with anticipation. It could end up showing us where bitcoin is headed,” Hougan wrote in a client note this week.

In addition,wWhile central banks have yet to enter the market, steady accumulation by exchange-traded funds (ETFs) and corporate treasuries has provided a similar source of structural demand.

Since the launch of spot Bitcoin ETFs in January 2024, institutions and corporations have purchased roughly 1.39 million BTC, far outpacing new supply generated by the network.

Market data this week supports the idea of renewed accumulation. Following a US$19 billion liquidation event earlier this month, spot Bitcoin ETFs recorded US$477 million in positive net inflows. This rebound has helped steady institutional confidence even as gold’s rally begins to cool after testing record highs.

Still, Bitcoin remains under short-term pressure, down more than 4 percent over the past week and trading below US$108,000.

Meanwhile, Ether (ETH) was priced at US$3,843.43, a 2.7 percent decrease in 24 hours. Its lowest valuation of the day was US$3,798.70, and its highest was US$4,106.40.

Altcoin price update

- Solana (SOL) was priced at US$184.80, down 2 percent over the last 24 hours. Its lowest valuation of the day was US$183.38 , and its highest was US$197.26.

- XRP was trading for US$2.39, a decrease of 2.6 percent over the last 24 hours. Its lowest was US$2.38 and its highest was US$2.53.

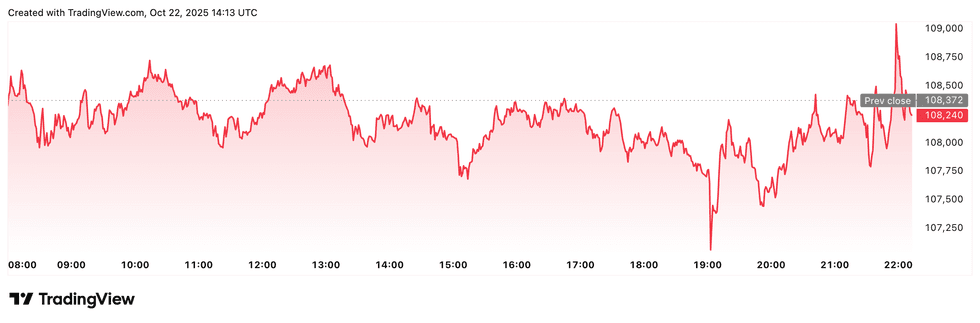

Fear and Greed Index snapshot

Chart via CoinMarketCap.

CMC’s Crypto Fear & Greed Index remains locked in a state of anxiety, sitting in “fear” territory (29) for seven consecutive days and markings its longest streak since April.

The sentiment gauge’s stagnation reflects a growing sense of caution among investors, as Bitcoin continues to trade within a narrow band between US$103,000 and US$115,000 for nearly two weeks.

Over the past 30 days, the index has been in greed territory for just seven days—the same period when Bitcoin reached its all-time high of YS$126,000 in early October. Since then, investor sentiment has reversed sharply. The current fear phase began on October 11, a day after the largest liquidation event in crypto history erased more than US$20 billion in leveraged positions.

Historically, similar periods of heightened fear have marked turning points for Bitcoin. The last extended stretch of fear occurred in March and April during the Trump administration’s tariff standoff with China, when Bitcoin bottomed near US$76,000.

Market analysts say the prevailing mood underscores uncertainty following the Federal Reserve’s recent policy pivot and renewed US-China trade negotiations.

Today’s crypto news to know

Senate Democrats demand Trump envoy explain undivested crypto stakes

Senate Democrats have called on Steve Witkoff, President Donald Trump’s special envoy to the Middle East, to explain why he has not divested from his crypto holdings despite federal ethics requirements.

In a letter led by Senator Adam Schiff, eight lawmakers pressed Witkoff for details on his interests in World Liberty Financial, the Trump-linked crypto firm he co-founded in 2024, and several affiliated entities.

Witkoff’s latest ethics disclosure, dated August 13, shows he still owns stakes in multiple crypto-related businesses, including WC Digital Fi LLC and SC Financial Technologies LLC. Lawmakers allege these investments pose potential conflicts of interest given his diplomatic role and the company’s business ties to the United Arab Emirates.

The scrutiny follows a New York Times report linking Witkoff’s crypto dealings to a US$2 billion Emirati investment in Binance funded through World Liberty Financial’s stablecoin, USD1.

Neither the White House nor World Liberty Financial has commented on the matter.

FalconX announced plans to acquire 21Shares

FalconX announced plans to acquire 21Shares, one of Europe’s leading crypto exchange-traded product (ETP) issuers.

The deal, confirmed Wednesday, will integrate FalconX’s prime brokerage operations, which serves over 2,000 institutional clients, with 21Shares’ portfolio of 55 listed products across Bitcoin, Ethereum, and other digital assets.

21Shares currently oversees more than US$11 billion in assets and will continue operating independently under CEO Russell Barlow following the acquisition.

While the financial terms remain undisclosed, the deal marks FalconX’s third major acquisition this year, following Arbelos Markets and Monarq Asset Management.

Hong Kong approves first spot Solana ETF

Hong Kong regulators have approved the region’s first spot Solana (SOL) exchange-traded fund.

The Securities and Futures Commission (SFC) granted authorization to China Asset Management Company (ChinaAMC) to launch the Hua Xia Solana ETF on the Hong Kong Stock Exchange on October 27.

The product will trade through OSL Exchange with OSL Digital Securities as sub-custodian and BOCI-Prudential Trustee Limited serving as the primary custodian. Each unit will consist of 100 shares, with a minimum investment of about US$100.

The fund’s debut makes Solana the third cryptocurrency—after Bitcoin and Ethereum—to receive regulatory approval for a spot ETF in Hong Kong.

Securities Disclosure: I, Giann Liguid, hold no direct investment interest in any company mentioned in this article.

Securities Disclosure: I, Meagen Seatter, hold no direct investment interest in any company mentioned in this article.