Crypto Market Update: SEC Clears Path for Crypto ETFs, Hyperliquid Launches Stablecoin

Here’s a quick recap of the crypto landscape for Wednesday (September 24) as of 9:00 p.m. UTC.

Get the latest insights on Bitcoin, Ether and altcoins, along with a round-up of key cryptocurrency market news.

Bitcoin and Ether price update

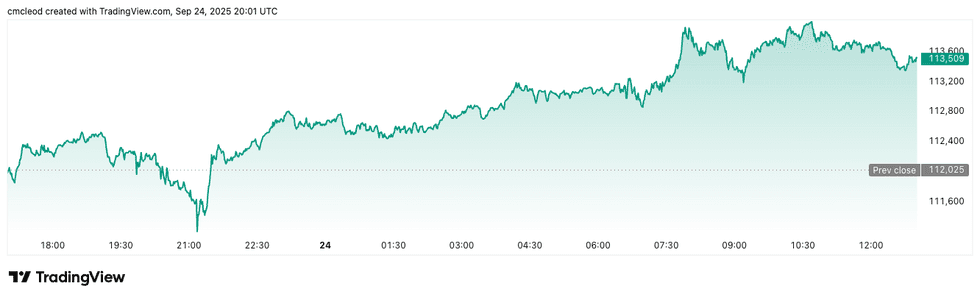

Bitcoin (BTC) was priced at US$113,474, trading 1.5 percent higher over the past 24 hours. Its lowest valuation of the day was US$1112,937, while its highest was US$113,941.

Bitcoin price performance, September 24, 2025.

Chart via TradingView.

Bitcoin has struggled to hold support near the US$111,600 to US$113,000 level amid growing seller pressure and a recent long liquidation event. However, the popular cryptocurrency recently staged a rebound to US$113,900, fueled by bullish divergences on the relative strength index and key technical levels. Crypto Chase notes that this signals a possible trend reversal if Bitcoin convincingly holds above US$113,400 to US$114,000.

Meanwhile, Bitcoin’s weekly Bollinger Bands are at their tightest level ever, signaling record-low volatility and the possibility of an imminent breakout. A confluence of dynamics points to a critical juncture for Bitcoin’s near-term trend, with downside risks balanced against strong seasonal potential for an “Uptober” rally.

Trader Ted Pillows highlights a large US$17.5 billion Bitcoin options expiry with “max pain” at US$107,000, suggesting Bitcoin could dip toward this level before a potential rebound. Trader Daan Crypto Trades anticipates heightened volatility with possible retests of US$107,000 and a volatile close to September, historically a weak month for Bitcoin.

Bitcoin dominance in the crypto market is 56.03 percent, showing a slight rise week-on-week.

For its part, Ether (ETH) was priced at US$4,163.18, trading 0.2 percent higher over the past 24 hours and near its lowest valuation of the day, which was US$4,158. Its price peaked at US$4,199.55.

Responding to comments made by Ben Horowitz, co-founder of Andreessen Horowitz, regarding the significance of artificial intelligence (AI) in blockchain economics, BitMine, the largest corporate holder of Ether, said Ether could enter a “supercycle” driven by growing Wall Street adoption and the rise of agentic AI platforms, which may catalyze an extended market cycle beyond traditional Bitcoin halving cycles.

Crypto derivatives and market indicators

Total Bitcoin futures open interest was at 719.56K BTC (equivalent to US$81.64 billion), down by 0.11 percent over four hours. Ether open interest was at 1380 million ETH, or US$57.39 billion, down 0.12 percent in four hours.

The perpetual funding rate was at -0.003 percent for Bitcoin and Ether, indicating bearish sentiment.

Bitcoin liquidations have reached US$2.65 million over the past four hours, with shorts representing the majority, signaling ongoing buying pressure. Ether liquidations show a divergent pattern, with US$2.65 million in short positions representing the vast majority of US$3.09 million liquidations over four hours.

Altcoin price update

- Solana (SOL) was priced at US$213.40, a slight decrease of 0.6 percent over the last 24 hours. Its lowest valuation of the day was US$211.88, while its highest value was US$215.94.

- XRP was trading for US$2.98, up by 4.6 percent to its highest valuation of the day. Its lowest was US$2.88 at the market’s open.

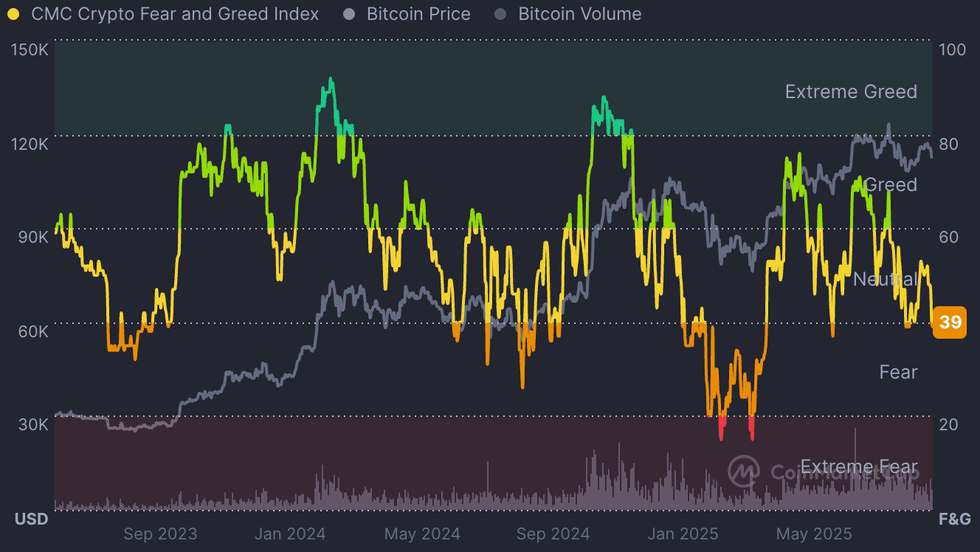

Fear and Greed Index snapshot

CMC’s Crypto Fear & Greed Index has remained firmly in neutral territory over the past week.

The index currently stands around 39, dipping into ‘fear’ territory for the first time in three weeks.

CMC Crypto Fear and Greed Index, Bitcoin price and Bitcoin volume.

Chart via CoinMarketCap.

Today’s crypto news to know

Aster gains steam, Hyperliquid launches stablecoin

Aster, a new DEX on Binance’s BNB Chain, has seen its open interest explode by almost 33,500 percent this week, increasing to US$1.2 billion at the time of this writing, according to CoinGlass data.

Aster has also accumulated US$2.01 billion TVL and over US$29 billion in perp volume over 24 hours, more than its biggest competitor, Hyperliquid, whose volume has reached US$10.09 billion in the same period.

Aster’s rapid growth challenges Hyperliquid, a top DEX for decentralized perpetual futures, which has seen the value of its HYPE token fall from US$59 to around US$45 in less than two weeks. Hyperliquid’s late 2024 token launch fueled a 2025 surge in decentralized perpetual futures trading, surpassing US$4.5 trillion.

Meanwhile, Hyperliquid launched its own stablecoin on Wednesday, with issuance rights awarded to Native Markets following a competitive governance bidding process. The 24 hour volume reached approximately 1.94 million.

Issuing its own stablecoin allows Hyperliquid to offer users a reliable digital dollar to use within its ecosystem for trading, lending and other financial activities, strengthening its position in the market.

SEC opens door to new wave of crypto ETFs

The US Securities and Exchange Commission has streamlined its rules for launching crypto exchange-traded funds (ETFs), paving the way for a flood of new products. Asset managers are already filing for ETFs tied to Solana, XRP and other tokens, which could arrive as early as October. Under the new framework, issuers no longer face a lengthy case-by-case review, cutting approval times from up to nine months to as little as 75 days.

Industry leaders say this will accelerate competition and lower barriers for investors seeking exposure to digital assets.

Grayscale was first to move, debuting a multi-coin ETF just two days after the rule change. Analysts anticipate that more launches will be announced before the year ends.

Record raise could give Tether US$500 billion valuation

Stablecoin giant Tether is reportedly seeking as much as US$20 billion from private investors in what could be one of the largest funding rounds in financial history, according to Bloomberg. The raise would give the company a valuation near US$500 billion, putting it in the same league as global tech leaders like SpaceX and OpenAI.

Executives say the capital would fuel expansion beyond the company’s core USDT stablecoin, into energy, AI, commodities trading and communications. Tether’s flagship token dominates the sector with a market capitalization above US$173 billion, more than twice that of its nearest competitor, USDC. The firm is also preparing to relaunch a compliant US dollar stablecoin, USAT, under the country’s new regulatory framework.

Ethereum co-founder warns against ‘closed tech’ in public systems

Ethereum co-founder Vitalik Buterin has raised concerns that closed, proprietary technologies are consolidating power in ways that threaten open innovation. In a recent blog post, he argues that closed systems across healthcare, identity and civic infrastructure create environments ripe for monopolies and abuse.

Buterin urged wider adoption of “full-stack openness,” including stronger copyleft licensing that forces companies to share improvements to open-source software. He also called for transparency in hardware and biological monitoring, citing pandemic-era vaccine distribution as an example of inequality driven by centralized control.

His comments come as the Ethereum Foundation and Solana Policy Institute collectively pledged US$1 million in legal support for Tornado Cash developer Roman Storm.

Securities Disclosure: I, Giann Liguid, hold no direct investment interest in any company mentioned in this article.

Securities Disclosure: I, Meagen Seatter, hold no direct investment interest in any company mentioned in this article.