Crypto Market Recap: Meme Coins Make Regulatory Waves, SEC Delays XRP and DOGE ETF Decisions

5 hours ago

Here’s a quick recap of the crypto landscape for Wednesday (April 30) as of 9:00 a.m. UTC.

Get the latest insights on Bitcoin, Ethereum and altcoins, along with a round-up of key cryptocurrency market news.

Bitcoin and Ethereum price update

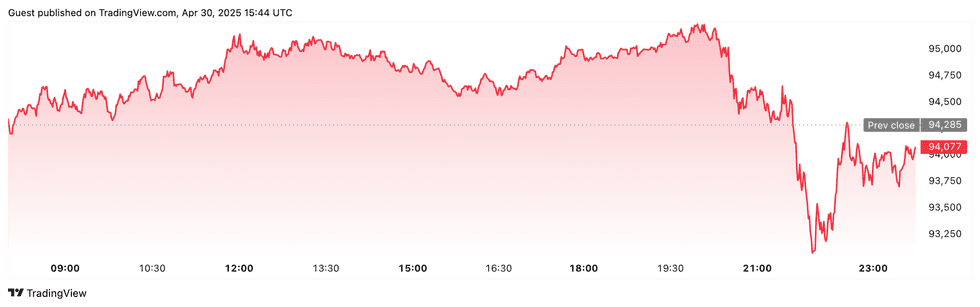

Bitcoin (BTC) was priced at US$94,697 as markets opened for the day, down 0.9 percent in 24 hours. The day’s range has seen a low of US$93,333.62 and a high of US$95,443.88.

Bitcoin performance, April 30, 2025

Chart via TradingView

Bitcoin’s price movements was shaped by mixed signals: Semler Scientific’s (NASDAQ:SMLR) US$15.7 million BTC purchase reflected ongoing institutional interest, while weaker US economic data—including negative Q1 GDP and the slowest job growth since July 2024—raised stagflation fears, weighing on sentiment.

Ethereum (ETH) ended the day at US$1,798.51, a 2.8 percent decrease over the past 24 hours. The cryptocurrency reached an intraday low of US$1,750.28 and a high of US$1,828.37.

Altcoin price update

- Solana (SOL) ended the day valued at US$146.91, down four percent over 24 hours. SOL experienced a low of US$141.31 and peaked at $150.06.

- XRP traded at US$2.23, reflecting a 5.9 percent decrease over 24 hours. The cryptocurrency recorded an intraday low of US$2.15 and reached its highest point at US$2.30.

- Sui (SUI) was priced at US$3.54, showing a decreaseof 4.4 percent over the past 24 hours. It achieved a daily low of US$3.32 and a high of US$3.61.

- Cardano (ADA) was trading at US$0.6959, down 4.7 percent over the past 24 hours. Its lowest price on Wednesday was US$0.6711, with a high of US$0.7156.

Today’s crypto news to know

SEC postpones decisions on XRP and DOGE ETFs

The US Securities and Exchange Commission (SEC) has extended its review period for two proposed spot cryptocurrency exchange-traded funds (ETFs) tied to XRP and Dogecoin, delaying any decision until mid-June.

The agency cited a need for more time to evaluate the filings, specifically the Bitwise DOGE ETF and the Franklin XRP Fund, and the legal issues they raise.

Under federal securities law, the SEC is allowed up to 90 days from the initial publication to make a decision, and this delay appears to fall within that window. Analysts speculated that the delay was anticipated and aligns with broader expectations that most final rulings will land in the fall.

While DOGE and XRP prices saw little immediate movement, the delay signals the SEC’s continued caution around expanding ETF offerings beyond bitcoin and ethereum.

Kraken launches ‘Embed’ service to let banks offer crypto trading

Crypto exchange Kraken is opening a new front in institutional crypto adoption with the launch of “Embed,” a plug-and-play crypto trading service for fintechs, neobanks, and traditional financial institutions.

Announced Wednesday, the service enables companies to integrate crypto trading directly into their apps and websites using Kraken’s APIs, bypassing the need to build costly infrastructure or secure their own licenses.

Amsterdam-based digital bank Bunq is the first to roll out the new service, debuting ‘Bunq Crypto’ to let European users trade digital assets within its existing app.

According to Kraken’s head of payments Brett McLain, the goal is to offer access to a wide range of tokens and fast asset listings, which he says sets Kraken apart from other white-label providers like Bitpanda.

Embed customers will pay variable service fees and share a portion of trading revenues with Kraken.

KuCoin pledges US$2 billion to Trust project

KuCoin announced a bold US$2 billion investment into what it’s calling the “Trust Project,” a sweeping initiative to restore user confidence and improve transparency across its platform.

The announcement was made during the TOKEN2049 conference in Dubai, where KuCoin executives laid out a roadmap focused on regulatory alignment, user protection, and responsible innovation.

A major component of the project involves giving the exchange’s native token, KCS, a larger role in governance, risk mitigation, and user reward structures. CEO BC Wong said the investment is aimed at securing the “long-term health” of the digital asset ecosystem by strengthening accountability and neutralizing systemic risks.

The initiative arrives as global regulators intensify their scrutiny of centralized exchanges and demand higher standards for custody, disclosures, and user safeguards.

Nasdaq files to list 21Shares Dogecoin ETF

In a fresh bid to tap into retail enthusiasm for meme coins, Nasdaq has submitted a formal application with the SEC to list the 21Shares Dogecoin ETF, according to a 19b-4 filing released Tuesday.

The ETF is designed to track Dogecoin’s market performance via the CF DOGE-Dollar Settlement Price Index and will hold the token directly, without using leverage or derivatives.

Coinbase Custody Trust has been named as the fund’s official custodian, offering added legitimacy and security to the proposed vehicle. The filing comes in the wake of 21Shares’ S-1 registration and its partnership with the House of Doge — a corporate arm of the Dogecoin Foundation — to promote the fund.

Although the SEC recently delayed a decision on Bitwise’s similar DOGE ETF, Nasdaq’s move signals sustained momentum behind bringing more meme coin exposure to regulated markets.

Securities Disclosure: I, Giann Liguid, hold no direct investment interest in any company mentioned in this article.

Securities Disclosure: I, Meagen Seatter, hold no direct investment interest in any company mentioned in this article.