Can Ethereum Price Touch $4,000 In 30 Days After ETH ETF Boom?

Despite its underperformance in this market cycle, crypto analysts continue to provide a bullish outlook for the Ethereum price. These analysts have suggested that ETH can rally to $4,000 in thirty days amid the Ethereum ETF boom.

Can The Ethereum Price Touch $4,000 In 30 Days?

Crypto analysts have suggested that the Ethereum price can reach $4,000 in thirty days amid the ETH ETF boom. These analysts include Ted, who recently predicted that ETH will reach $4,500 this month. This came as the analyst also predicted that the crypto could reach $10,000 in the next three to four months.

In a recent X post, the analyst again reaffirmed his conviction about Ethereum and outlined why he is very bullish on ETH. First, he mentioned that Donald Trump’s World Liberty Financial had bought over $200 million worth of ETH.

Secondly, the analyst mentioned that Eric Trump is tweeting about ETH, which he considers bullish for the Ethereum price. Trump has tweeted that he believes now is a “great time” to buy ETH.

The crypto analyst then asserted that Ethereum staking ETF will be approved, which is also a bullish fundamental ETH. It is worth mentioning that Kraken has already relaunched its crypto staking services for US customers, a move that could be geared towards the approval of this staking ETF.

Other fundamentals the analyst alluded to that could drive the ETH price to $4,000 in thirty days include upcoming network upgrades, which could lead to lower fees, better staking, and an improved token burn mechanism.

Ted also added that Ethereum is the only smart contract platform with a commodity-classified coin and spot ETF support. The analyst noted that major players like Deutsche Bank and UBS are building on Ethereum layer-2.

ETH ETF Boom Provides A Bullish Outlook

The Ethereum ETF boom also provides a bullish outlook for the ETH price. These funds recorded $83.6 million in net inflows yesterday, sparking a bullish sentiment among investors.

This development is even more significant considering that the Bitcoin ETFs recorded $2334.4 million in net outflows yesterday. As such, institutional investors look to be heavily bullish on ETH and used the crypto market crash yesterday as an opportunity to accumulate more Ethereum. These investors have been accumulating the crypto since last week, with these funds recording significant inflows.

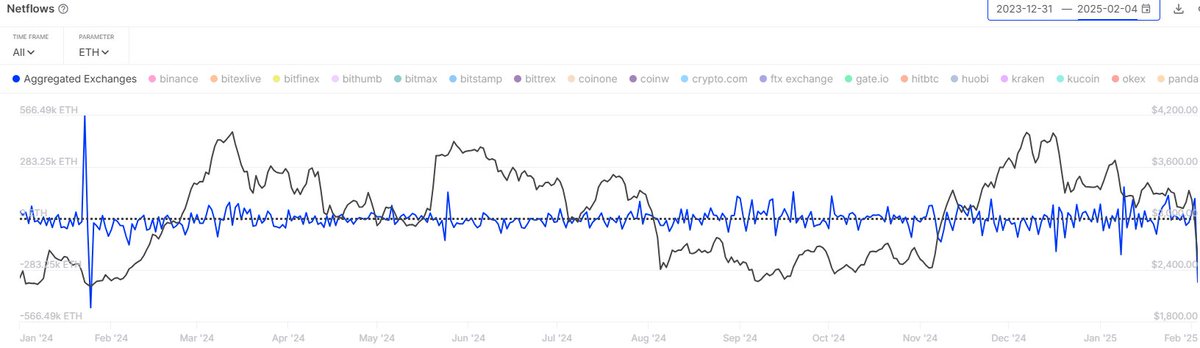

Crypto whales are also still bullish on the Ethereum price despite its underperformance. Market intelligence platform IntoTheBlock revealed that 350,000 ETH worth nearly $1 billion was withdrawn from exchanges yesterday.

The platform further revealed that this is the highest amount of net exchange withdrawals since January 2024. As such, traders took advantage of the dip alongside these institutional investors.

Another Bullish Case For ETH

Crypto analyst Titan of Crypto also shared an Ethereum price analysis, which suggested that ETH could reach $4,000 in the next thirty days. In an X post, the analyst noted that ETH’s current cycle behavior closely mirrors Bitcoin’s past cycle right before its breakout and major run-up.

The analyst added that history repeats, but it often rhymes. His accompanying chart showed that the Ethereum price could break above $4,000 and rally to as high as $8,200 this year as part of this run-up phase.

The post Can Ethereum Price Touch $4,000 In 30 Days After ETH ETF Boom? appeared first on CoinGape.