Brixton Metals Commences Drilling At Its Langis Silver Project

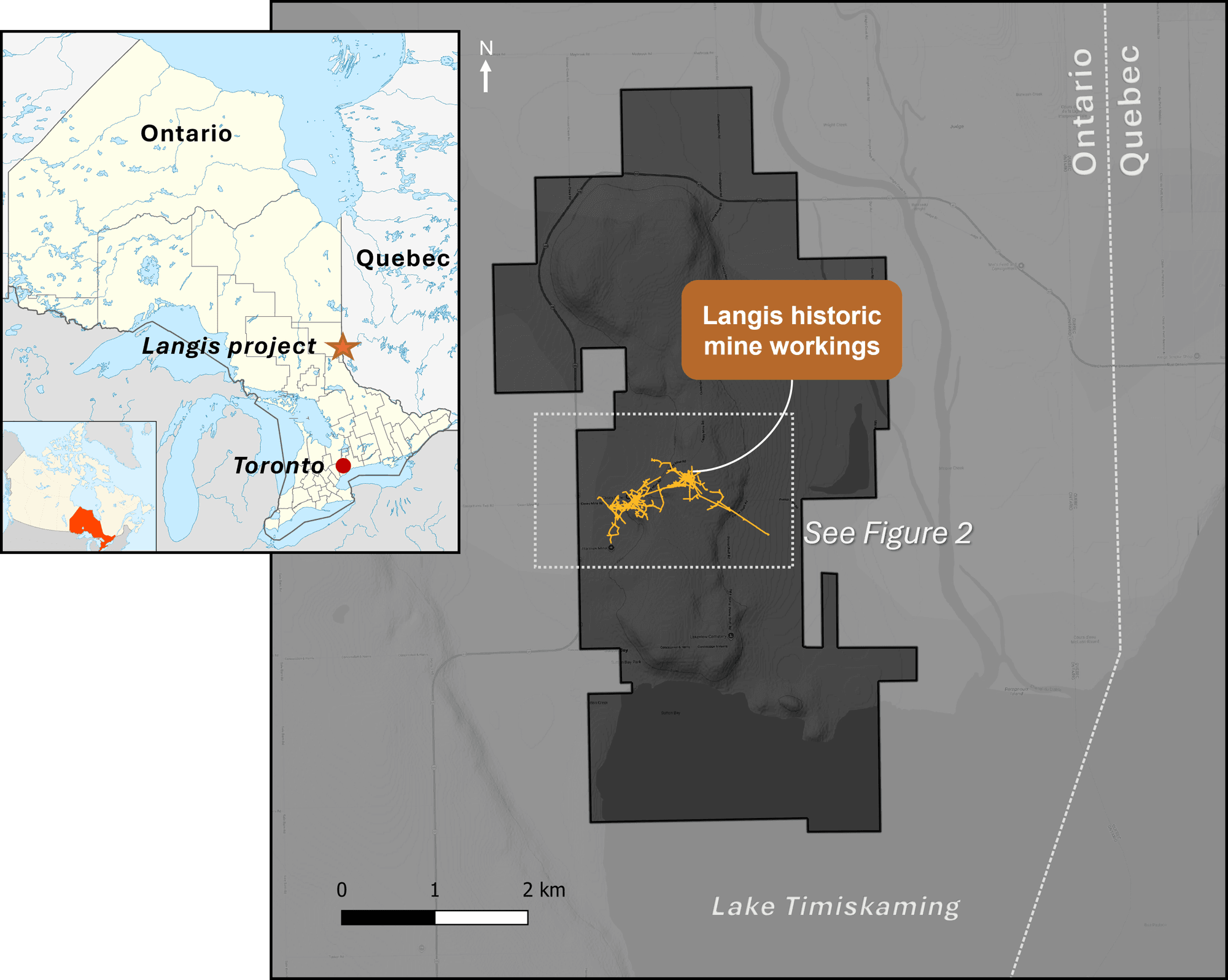

Brixton Metals Corporation (TSX-V: BBB, OTCQB: BBBXF) (the ‘Company’ or ‘Brixton’) is pleased to announce the launch of drilling activities at its wholly owned Langis Silver Project, located in the historic, silver rich Cobalt Camp of Ontario, approximately 500km north of Toronto (Figure 1). The site benefits from excellent infrastructure, including all-season road access, power, rail connections, and a refiner.

Highlights

- The fully funded 2026 phase one drill campaign will comprise of approximately 15,000 meters of shallow near-surface drilling, targeting both the expansion and infill of established high-grade silver zones, as well as exploring new areas of mineralization along structural trends.

- Silver mineralization at Langis occurs as native silver in veins, veinlets, disseminated, rosettes and fracture infill, often associated with minerals such as calcite, hematite, pyrite, cobaltite, chalcopyrite, niccolite and gold.

- Rock grab samples from the Shaft 7 dump returned up to 182,065 g/t silver.

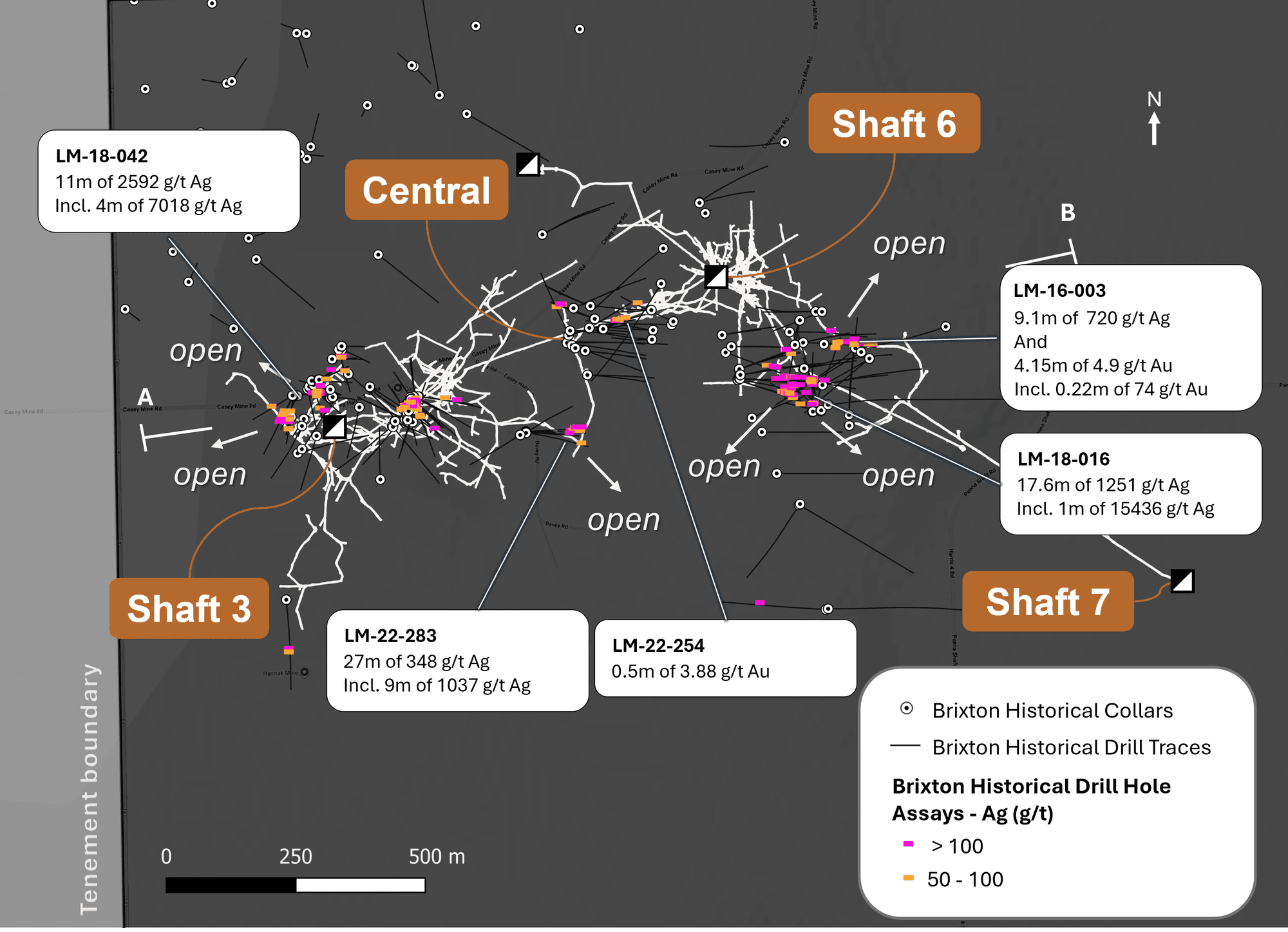

- Previous drilling by Brixton has yielded 15 intercepts greater than 1000 g/t Ag, including 3 intercepts greater than 5000 g/t Ag in the Shaft 3 area;10 intercepts greater than 1000 g/t Ag and 5 intercepts greater than 5000 g/t Ag in the Shaft 6 area;

- 11m of 2592 g/t silver, including 4m of 7018 g/t silver, Shaft 3 area

- 17m of 970 g/t silver, including 11m of 1289 g/t silver, Shaft 3 area

- 27m of 348 g/t silver, including 9m of 1037 g/t silver, Central area

- 17.6m of 1251 g/t silver, including 1m of 15436 g/t silver, Shaft 6 area

- 71m of 121 g/t silver, including 4m of 1186 g/t silver, Shaft 6 area

Chairman, CEO, Gary R. Thompson stated, ‘We are excited to commence drilling at the Langis Silver Project at a time when silver prices are exceptionally strong. This highly favourable silver market allows us to maximize the value of our exploration efforts for shareholders. Our main goal with this drill program is to expand the high-grade silver zones with sufficient drilling to establish an independent maiden mineral resource estimate at Langis. While most of the drilling by Brixton has focused on brownfield work in and around the mine workings, much of the project with favourable geology has yet to be drill tested, so the new discovery potential remains very high on the project.’

Figure 1. Langis Silver Project location and claim map with historical mine workings.

Discussion

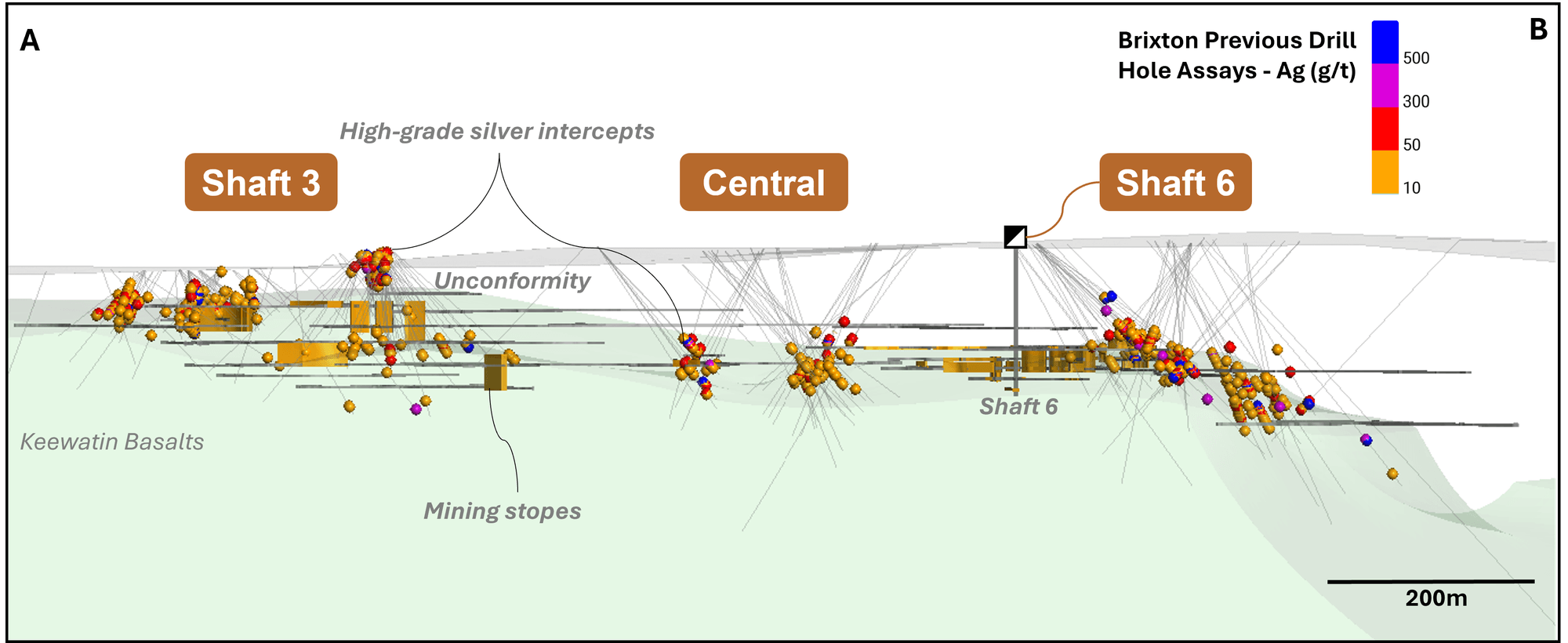

The Langis Project is a primary silver brownfield exploration project with secondary gold and cobalt mineralization, which are believed to result from distinct mineralizing events. Mineralization has been identified near contacts with the Nipissing diabase, and at the unconformity between Archean Keewatin basement rocks and the overlying Huronian sediments (Figure 3). Many areas with favourable geology, away from the historical workings, remain to be drill-tested.

Silver is predominantly hosted in vertical, dilatant zones and shear veins, occurring as native silver and silver arsenide. To date, Brixton yielded 220 intervals exceeding 100 g/t Ag with 15 intercepts greater than 1000 g/t Ag, including 3 intercepts greater than 5000 g/t Ag in the Shaft 3 area, 10 intercepts greater than 1000 g/t Ag and 5 intercepts greater than 5000 g/t Ag in the Shaft 6 area, 2 intercepts greater than 1000 g/t Ag in the Central area.

Gold mineralization has been observed locally, particularly around the Shaft 6 area. Examples include drill hole LM-16-003, which returned 4.15m of 4.90 g/t gold, including 0.22m of 74 g/t gold (news release, dated October 18, 2016) and 0.5 meters grading 3.88 g/t Au in hole LM-22-254. Gold remains largely underexplored, and historically, it has not been analyzed in this area.

Since 2016, Brixton has conducted five drill campaigns, resulting in over 40,315 meters drilled at the Langis Project, with a focus on high-grade silver near historic workings. For the 2026 season, the company aims to extend and infill known high-grade silver zones and to test new targets within established structural trends. The goal is to lay the groundwork for a potential maiden resource estimate.

Figure 2. Plan Map of the Langis Mine workings and select drill intercepts.

All reported drill intercepts in the news release are drilled lengths, and true width has not been determined at this time.

Figure 3. Long section of Langis from A (west) to B (east), looking north.

Table 1. Summary of the ten highest-grade silver drill holes completed by Brixton at the Langis Project between 2016 and 2022, as previously reported.

| Area | Hole ID | From | To | Interval | Silver |

| meter | meter | meter | g/t | ||

| Shaft 3 | LM-18-042 | 13.00 | 24.00 | 11.00 | 2592.88 |

| including | 19.00 | 23.00 | 4.00 | 7018.75 | |

| Shaft 3 | LM-20-083 | 6.00 | 24.00 | 18.00 | 363.21 |

| including | 11.00 | 17.00 | 6.00 | 1078.82 | |

| Shaft 3 | LM-20-133 | 16.60 | 33.60 | 17.00 | 970.46 |

| including | 16.60 | 27.60 | 11.00 | 1289.04 | |

| including | 30.60 | 31.60 | 1.00 | 1500.00 | |

| Shaft 3 | LM-20-131 | 8.90 | 33.90 | 25.00 | 282.70 |

| including | 8.90 | 14.90 | 6.00 | 1115.02 | |

| LM-18-044 | 9.00 | 22.00 | 13.00 | 504.52 | |

| including | 12.00 | 18.00 | 6.00 | 1031.75 | |

| Central | LM-22-283 | 163.50 | 190.50 | 27.00 | 348.53 |

| including | 165.00 | 174.00 | 9.00 | 1037.43 | |

| Shaft 6 | LM-18-016 | 149.00 | 166.60 | 17.60 | 1251.18 |

| including | 159.56 | 160.56 | 1.00 | 15436.00 | |

| Shaft 6 | LM-16-003 | 179.41 | 188.51 | 9.10 | 720.40 |

| including | 179.41 | 185.47 | 6.06 | 1007.07 | |

| Shaft 6 | LM-18-039 | 183.10 | 195.00 | 11.90 | 536.63 |

| including | 187.10 | 192.00 | 4.90 | 1155.14 | |

| Shaft 6 | LM-21-219 | 117.80 | 188.80 | 71.00 | 120.91 |

| including | 135.80 | 139.80 | 4.00 | 1186.00 | |

| including | 141.80 | 142.80 | 1.00 | 1490.00 |

About the Langis Project

The wholly owned Langis Silver Project includes a former producing mine, approximately 500 kilometres north of Toronto, Ontario, Canada, with excellent infrastructure. Silver mineralization is found as native silver and within steeply to moderately dipping veins, veinlets, disseminations, rosettes, and fracture infill, often associated with minerals such as calcite, hematite, pyrite, cobaltite, chalcopyrite, niccolite, and gold. Mineralization is hosted across three principal rock types: Archean Keewatin volcanic and metasedimentary rocks, Proterozoic Coleman Member sedimentary rocks of the Huronian Supergroup, and Proterozoic Nipissing diabase. The geological ore deposit model for this area is considered to be a continental rift-extensional deposition environment. Intermittently from 1908 to 1989, the Langis Mine produced 10.4 million ounces of silver at a head grade of 777.5 g/t silver or 25 opt silver. Reported silver recoveries at Langis were 88% to 98%. Over 10km of underground workings were developed by previous operators; however, shafts and openings have been capped and sealed. Historically, silver mines in the Cobalt Camp have collectively produced over 500 million ounces of silver.

Qualified Person (QP)

Mr. Martin Ethier, P.Geo., is a consultant for the Company who is a Qualified Person as defined by National Instrument 43-101. Mr. Ethier has verified the referenced data and analytical results disclosed in this press release and has approved the technical information presented herein.

About Brixton Metals Corporation

Brixton Metals is a Canadian exploration company focused on the advancement of its mining projects. Brixton wholly owns four exploration projects: Brixton’s flagship Thorn copper-gold-silver-molybdenum Project, the Hog Heaven copper-silver-gold Project in NW Montana, USA, which is optioned to Ivanhoe Electric Inc., the Langis and HudBay silver Projects in Ontario and the Atlin Goldfields Project located in northwest BC, which is optioned to Eldorado Gold Corporation. Brixton Metals Corporation shares trade on the TSX-V under the ticker symbol BBB, and on the OTCQB under the ticker symbol BBBXF. For more information about Brixton, please visit our website at www.brixtonmetals.com.

On Behalf of the Board of Directors

Mr. Gary R. Thompson, Chairman and CEO

info@brixtonmetals.com

For Investor Relations inquiries please contact: Mr. Michael Rapsch, Vice President Investor Relations. email: michael.rapsch@brixtonmetals.com or call Tel: 604-630-9707

Follow us on:

LinkedIn | Twitter/X | Facebook | Instagram

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Information set forth in this news release may involve forward-looking statements under applicable securities laws. Forward-looking statements are statements that relate to future, not past, events. In this context, forward-looking statements often address expected future business and financial performance, and often contain words such as ‘anticipate’, ‘believe’, ‘plan’, ‘estimate’, ‘expect’, and ‘intend’, statements that an action or event ‘may’, ‘might’, ‘could’, ‘should’, or ‘will’ be taken or occur, including statements that address potential quantity and/or grade of minerals, potential size and expansion of a mineralized zone, proposed timing of exploration and development plans, or other similar expressions. All statements, other than statements of historical fact included herein including, without limitation, statements regarding the use of proceeds. By their nature, forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause our actual results, performance or achievements, or other future events, to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. Such factors include, among others, the following risks: the need for additional financing; operational risks associated with mineral exploration; fluctuations in commodity prices; title matters; and the additional risks identified in the annual information form of the Company or other reports and filings with the TSXV and applicable Canadian securities regulators. Forward-looking statements are made based on management’s beliefs, estimates and opinions on the date that statements are made and the Company undertakes no obligation to update forward-looking statements if these beliefs, estimates and opinions or other circumstances should change, except as required by applicable securities laws. Investors are cautioned against attributing undue certainty to forward-looking statements.

Photos accompanying this announcement are available at:

https://brixtonmetals.com/wp-content/uploads/2026/01/Fig-1-NR-Jan-12-2026-scaled.png

https://brixtonmetals.com/wp-content/uploads/2026/01/Fig-2-NR-Jan-12-2026w-scaled.png

https://brixtonmetals.com/wp-content/uploads/2026/01/Fig-3-NR-Jan-12-2026-scaled.png

News Provided by GlobeNewswire via QuoteMedia