Bostic signals Fed skip on rate cuts in November can’t be ruled out

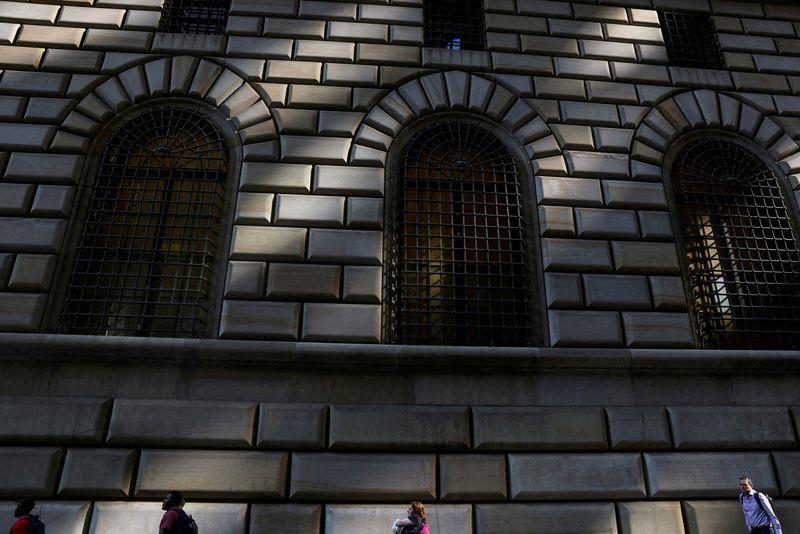

Investing.com — Atlanta Federal Reserve President said Thursday he was open to downshifting to a quarter point rate cut or may even support an unchanged decision should the recent bout of stronger inflation and labor market persist.

“I am totally comfortable with skipping a meeting if the data suggests that’s appropriate,” said Atlanta Fed President Raphael Bostic in an interview Thursday,. The remarks arrived on the heels of data showing that the September consumer price index, a measure of inflation, surprised to the upside.

The consumer price index (CPI). was 0.2% in September, unchanged rom August but above the 0.1% expected. That took the annual pace through August to 2.4%, down from 2.5% in August, but above expectations of 2.3%.

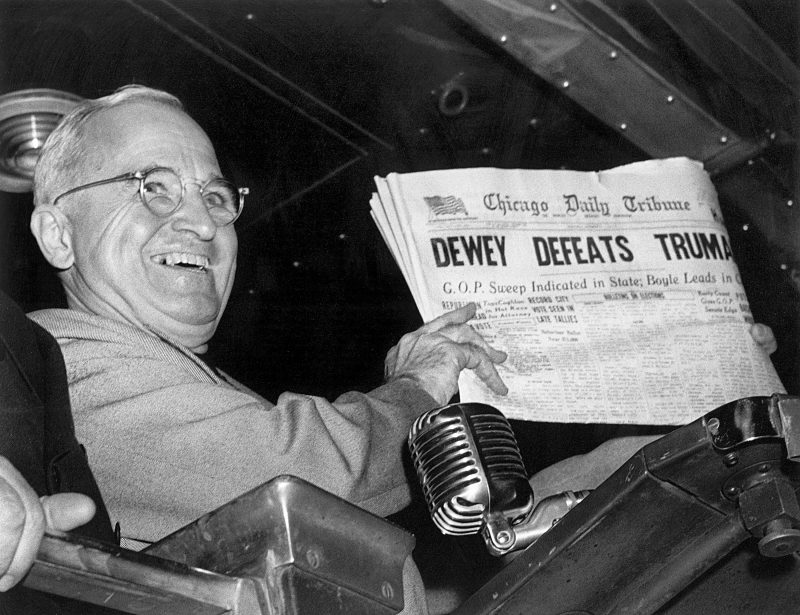

The hotter inflation report followed the recent September payrolls report that markedly beat estimates and forced many on Wall Street to reassess their bets for another half a point cut at the Fed’s November meeting.

The stronger-than-expected pace of inflation and job gains was the first upside surprise in five and two months, respectively.

The choppiness in the data, Bostic said, maybe signals that “we should take a pause in November.” He added: “I’m definitely open to that.”

“I think we have the ability to be patient and wait and let things play out a little longer…. There are elements of today’s report which I think validate that view,” the Atlanta Fed chief said.

This post appeared first on investing.com