Bitget CLO: New SEC Chair Paul Atkins Could Push Forward Conditional ETF Approvals

New SEC Chair:- There is so much happening in crypto and web3 as of now. The biggest gala of crypto leaders and champions is gathering at Token 2049 in Abu Dhabi.

Crypto market is turning bullish with BTC crossing $96,000 as of writing. XRP ETFs have been launched in Canada. Trade Fi and DeFi are integrating and innovating at an unprecedented pace.

Another such important happening is the sworn-in of new SEC Chair Paul Atlkins on April 21. Considered as the pro-crypto ally, he already has connections with the industry – holding around $6 million in crypto-related investments.

Atkins is serving out the remainder of former SEC Chair Gary Gensler’s term, which is set to expire on June 5, 2026.

From now, his over 1-year tenure as the chairman of the US’s top regulatory body – Securities and Exchange Commission (SEC) – will be pivotal for the crypto market and web3 industry.

To understand this impact, BrandTalk by CoinGape talks with Bitget Chief Legal Officer Hon. N in this Power Talk.

Bitget CLO critically explains the impact of new SEC Chair on hottest trends of Web3, viz., Stablecoins, RWA Tokeniations, ETFs, regulatory clarity and expected legislations.

New SEC Chair to Led Path Towards Regulatory Clarity

Paul Atkins made his first public appearance as the new SEC Chair on April 25. In the first crypto roundtable, he sought for more clear crypto regulations for the web3 industry.

Bitget CLO Hon N. who has worked previously for Binance says, “Atkins is someone who has actively worked in the crypto industry. In the latest crypto roundtable, his message was regulatory clarity — and that’s what industry players really need.

Businesses are not asking for an open pass to do anything they want. Rather, we want clear guidance and no more confusion on what compliance looks like. Under Atkins’ leadership, we believe that the SEC will provide that clarity.

That clarity alone removes huge legal uncertainty and keeps innovation onshore.

He has called on the previous SEC administration for stifling innovation in the crypto industy for the last several years due to market and regulatory uncertainty.

During the roundtable speech, he has hinted changes to custody rules under the Exchange Act, Advisers Act, or Investment Company Act to accommodate crypto assets and blockchain technology. He is also working for a new crypto asset broker-dealer framework if needed.

As founder and CEO of Patomak Global Partners, new SEC Chair Atkins has advised numerous cryptocurrency exchanges and blockchain startups on regulatory strategy and compliance.

Since 2017, he is also serving as the co-chair of the Token Alliance which is a leading industry advocacy group that works to shape sensible crypto regulation.

Also Read: Eric Trump’s Prediction for Crypto!

Impact on ETFs

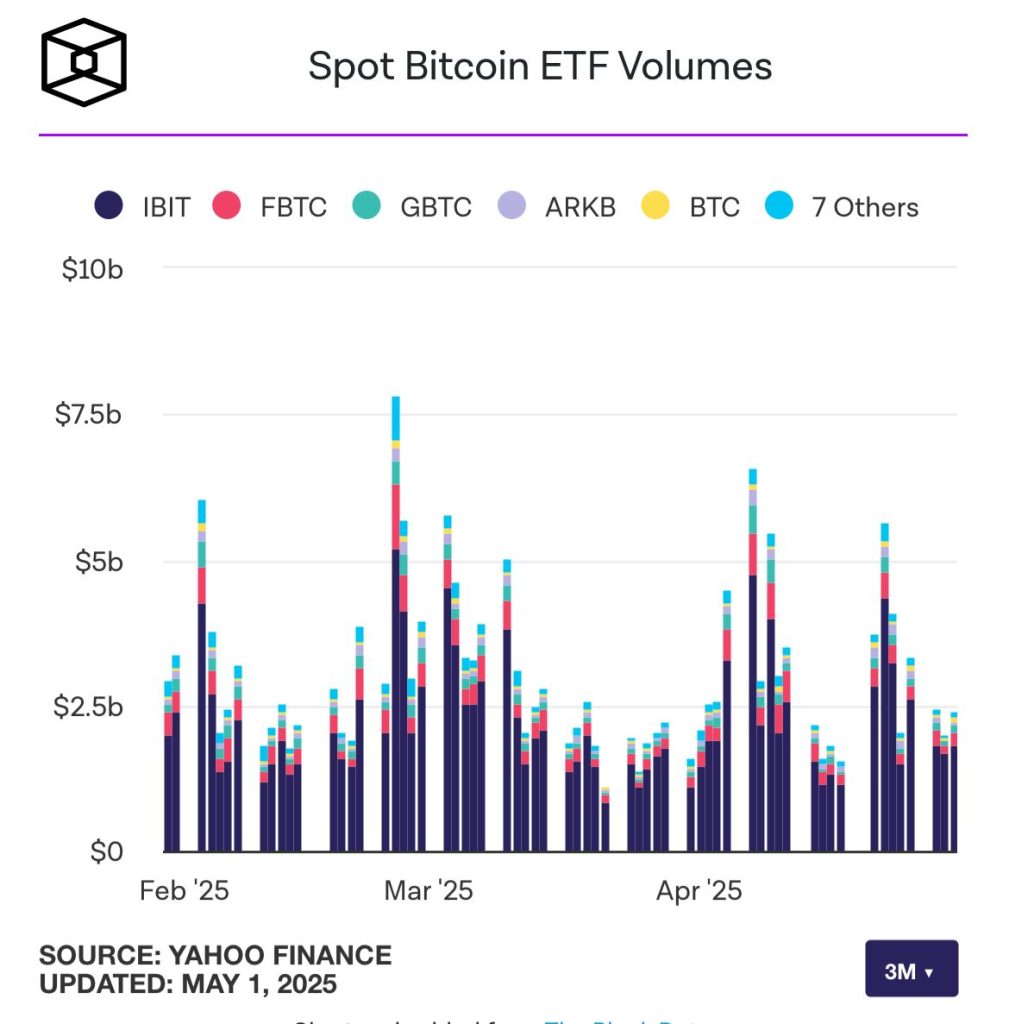

With the increasing interest in crypto, there is a notable surge in ETF filings. There are a growing number of pending ETF applications with the SEC.

Nasdaq filed a Form S-1 today to list and trade shares of the 21Shares Dogecoin ETF. Bitwise’s proposal for a spot XRP ETF has entered its initial 90-day review window.

VanEck has also formally submitted a registration for a spot Avalanche (AVAX) ETF. Bitget CLO Hon N. seems bullish action likely for these applications with the new SEC Chair.

So, the SEC currently has over 70 altcoin ETF applications pending approval. And they are continuously delaying the decisions. It tells me that the Commission is likely working on a new framework for approval, says Bitget CLO Hon. from his over 18 years of experience in the legal and business fields,

Paul Atkins might empower staff to grant “conditional approvals” for pending altcoin funds. He can set straightforward guardrails — like capital requirements and liquidity tests — so issuers know exactly which box to check.However, these are assumptions — and while they might materialize, the new SEC chair has a lot on his plate, and not every single decision will be immediate.

Global ETF net sales totaled roughly $314.5 billion in Q1 2025. This was driven largely by the Big Three promoters—iShares (+$109.6 billion), Vanguard (+$104.0 billion), and Invesco (+$20.4 billion).

Also Read: Grayscale Launches Bitcoin Adopters ETF

What Should be his Top Legislative Priorities

In 2024, the SEC initiated 33 crypto-related enforcement actions against major crypto companies including Ripple, Kraken. It imposed $4.98 billion in penalties for fraud and unregistered offerings.

Whatever rules the regulatory body makes under the new SEC chair will ultimately set the course for the web3 industry.

Bitget CLO believes, “Ideally Atkins should push Congress and his staff to tackle three core areas first. Stablecoin legislation tops the list: defining covered, fully-backed dollar tokens as payment instruments will secure consumer trust and let banking regulators step in.

Also, the tokenization framework needs clear, safe harbors for digital shares, bonds, and funds — aligning Investment Company Act requirements with modern platforms.

On stablecoins, he could deploy a dedicated Safe Harbor Pilot, allowing issuers to operate under transparent reserve‐audit and redemption rules for, say, 12–18 months while the SEC collects real‐world data.

Third, the SEC must finalize custody rules and a “special purpose broker-dealer” structure so exchanges and wallets can hold assets without jumping through hoops.

On the rule side, guidance on DeFi lending and staking will help protocols design compliant products. The Commission should also revisit crowdfunding limits to allow more projects to raise capital through transparent disclosures.

Can the new SEC Chair Solve the Hottest Debate of Disgreement

Classifying crypto assets as ‘security vs. commodity’ debate has been the most pressing debate for the US crypto market in the past five years. It has become the root cause of almost every major lawsuit the industy has witnessed.

Bitget CLO believes the new SEC Chair can extinguish this long-burning fire.

Atkins is uniquely positioned to draw a clearer line between securities and commodities. The recent guidance from the Commission’s crypto task force already treats fully-backed dollar stablecoins as non-securities and carves out other niche segments from SEC’s jurisdiction.

Building on that, I think he’ll lean on the Howey test’s focus on “investment contracts,” ensuring only tokens sold with profit-expectation marketing face securities rules. He has promised to work closely with the CFTC, banking agencies, and Congress to prevent overlap and confusion.

Ultimately, Atkins’ approach should leave true payment and commodity tokens in the CFTC’s scope, while investment-style tokens land squarely under SEC authority.

Can SEC turn from an Aversary to Friend for Web3

The new SEC chair can chart a new course of regulatory history by pionerring pro-crypto legislations in the country. His over 1-year tenure leaves the web3 companies and leaders hoping for better prospects and favourable landscape.

Bitget CLO concludes, eyeing “Atkins’ future industry roundtables on tokenization and DeFi. We’ll finally get targeted rules instead of broad fears.

While he won’t let fraud go unchecked, his focus on cost-benefit analysis and legislative fixes means the SEC will likely act more like a partner than an adversary.

In the long term, I expect him to propose joint roundtables with the FCA and EU authorities and to support global bodies like the Financial Stability Board in drafting voluntary guidelines. That collaborative stance will nudge national regimes toward a more interoperable, globally coherent rulebook.

My last advice for him would be to establish clear pilot programs. Instead of decades-long rulemakings, he could set short-term Safe Harbor Pilots with defined metrics for stablecoins, tokenized securities, and ETFs.

The post Bitget CLO: New SEC Chair Paul Atkins Could Push Forward Conditional ETF Approvals appeared first on CoinGape.