Bitcoin Bull Samson Mow Urges Japan to Buy 167,000 BTC, Here’s Why

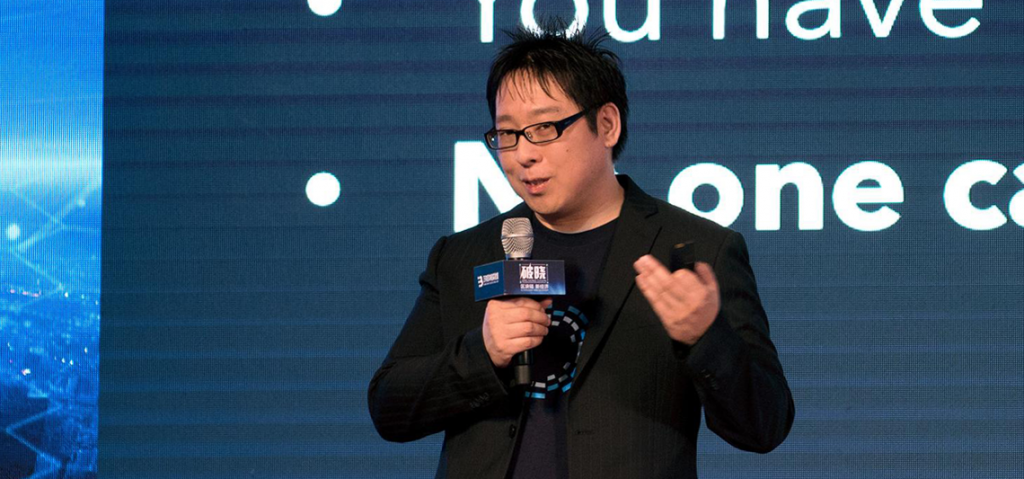

Samson Mow, a Bitcoin advocate and CEO of JAN3, is encouraging the Japanese government to acquire 167,000 BTC. This suggestion came after a Bitcoin and Layer 2 conference in Japan, which focused on promoting the crypto adoption at a governmental level.

The conference was attended by representatives from major banks, fintech firms, and regulatory bodies in Japan. Mow highlighted BTC’s attributes such as growth potential and scarcity, aligning them with Japan’s preference for hard assets like gold.

Samson Mow Urges Japan to Buy 167,000 BTC

Samson Mow’s call for Japan to invest in Bitcoin follows his analysis of the nation’s gold reserves. Citing Japan’s significant holdings of gold, Mow argues that the top crypto could serve a similar function in diversifying and securing national reserves.

He suggests that Japan’s 846 tons of gold, which accounts for only a small fraction of its foreign exchange reserves, could be complemented by the acquisition of BTC to hedge against economic volatility. Mow further justifies his comparison of the crypto’s finite supply to that of gold saying the BTC is the “hardest asset in existence.”

Additionally, in a recent closed-door meeting with Junichi Kanda, Japan’s Minister of State for Financial Services, Mow further discussed the implications of adding BTC to the country’s reserve assets.

JAN3 CEO Samson Mow met with Mr. Junichi Kanda, Parliamentary Vice-Minister of the Cabinet Office. They discussed the potential for #Bitcoin in Japan, nation-state adoption around the world & implications of US Strategic Bitcoin Reserves. Thank you @Jun1CanDo for welcoming us! pic.twitter.com/dpnhrB3Gq6

— JAN3 (@JAN3com) September 20, 2024

Regulatory Challenges and Economic Policy Adjustments

However, Japan’s regulatory framework for crypto has been tightening, potentially stifling the growth of digital assets within the country. These regulations require companies to achieve high compliance standards, which could discourage new entrants in themarket.

Concurrently, the Bank of Japan (BOJ) has signaled potential rate hikes in the coming months. This economic adjustment aims to stabilize the Japanese yen and curb inflation but might influence the crypto market indirectly. Higher interest rates strengthen the national currency and make BTC less attractive as an alternative investment like proposed by Samson Mow.

Bhutan and Global BTC Adoption

Surprisingly, recently Bhutan became the fourth-largest government holder of BTC with holdings valued at over $750 million. Bhutan has accumulated its Bitcoin through proactive investments in the crypto mining, supported by the country’s hydropower resources.

Despite Samson Mow’s push for the Bitcoin adoption, gold advocate Peter Schiff has pointed out that gold has reached another record high. Schiff suggests that the market’s focus on BTC overshadows movements in traditional safe-haven assets like gold.

The post Bitcoin Bull Samson Mow Urges Japan to Buy 167,000 BTC, Here’s Why appeared first on CoinGape.