Anteros Initiates Critical Mineral Deposit Modelling at Their Havens Steady VMS Property in Newfoundland

Anteros Metals Inc. (CSE: ANT) (‘Anteros’ or the ‘Company’) is pleased to announce commencement of inaugural 3D modeling at its 100%-owned critical-mineral-bearing Havens Steady Property (the ‘Property’). The Property boasts a road-accessible Volcanogenic Massive Sulphide (‘VMS’) lead-zinc-silver ±copper-gold deposit, is close to hydroelectric power, and is located in an established mining district in south-central Newfoundland. Modelling of recently-digitized historical data will allow for effective targeting of zone extensions and the identification of wider and higher-grade zones, including areas of copper-gold enrichment. Follow-up exploration is scheduled for late spring and early summer 2025.

PROPERTY HIGHLIGHTS

- Situated in a region renowned for significant Kuroko-type VMS deposits, known for their rich polymetallic characteristics and significant economic yields

- Geologically consistent mineral deposit with a 1,000-meter strike length of lead-zinc-silver ±copper-gold mineralization

- Notable high-grade intercepts (Table 1), including 2.72 metres of 2.1% Cu, 3.6% Pb, 6.17% Zn, 56.42g/t Ag and 1.82g/t Au in historical drill hole HS09-18 from 97.42 to 100.14 metres

- Road accessible and proximal to past-producing VMS mine-sites and infrastructure

- Approximately 8,150 metres of historical drilling since 1986, the most recent of which was conducted in 2009 (approximately 1,145 metres)

- Fully permitted for exploration diamond drilling from the Mineral Lands Division of Newfoundland and Labrador

LOCATION AND MINERAL TENURE

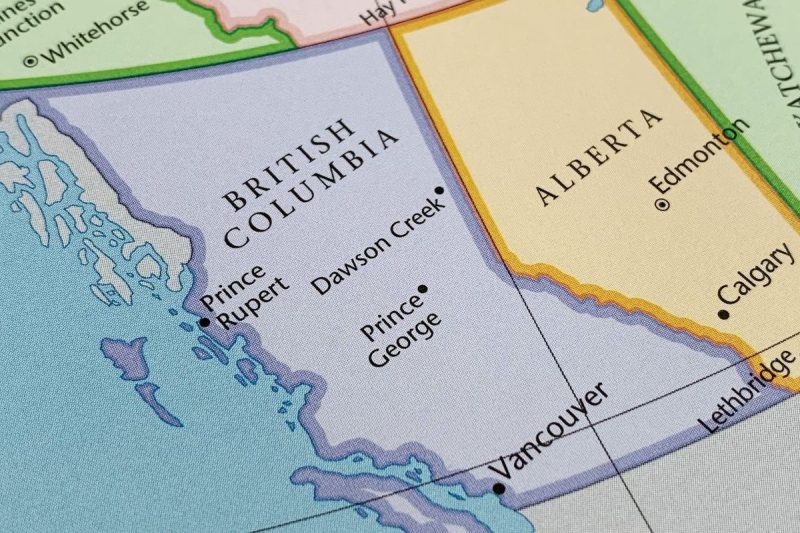

The Property lies 15 kilometres south of the past-producing Duck Pond lead-zinc-copper VMS mine and 40 kilometres southeast of the town of Buchans (Figure 1). The Property is comprised by seven claims covering 175 hectares in the prolific Buchans-Victoria Lake area. Hosted by rocks of the Red Cross Group volcanic belt, the Property hosts high-grade VMS-style base and precious metal mineralization, including critical minerals zinc and copper.

Figure 1: Havens Steady Property location (1:350,000 scale)

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/9885/240423_5213bd8154dc49d4_002full.jpg

REGIONAL AND PROPERTY GEOLOGY

The Havens Steady Property is situated within the Central Mobile Belt of the Dunnage Zone in Newfoundland and Labrador. The region is underlain by sequences of Cambrian to Silurian volcanic and sedimentary rocks and related intrusive rocks. The Property borders the Victoria Lake Supergroup, a complex assortment of several distinct volcanic sequences, some of which host world class VMS deposits such as the past-producing Duck Pond VMS Mine, which had reserves of 4.078 million tonnes grading 3.29% Cu, 5.68% Zn, 59.3g/t Ag and 0.86g/t Au and an additional inferred and measured 1.073 million tonnes of 3.04% Cu, 7.05% Zn, 71.2g/t Ag and 0.8g/t Au prior to the commencement of mining operations in 2006 (Canadian Mining Journal, Aug 1, 2006).

The Property is dominated by felsic volcanic rocks interbedded with graphitic argillites and siltstones (Figure 2). Extensive sericitization and silicification within the felsic volcanic units occurs with chloritic alteration associated near zones of massive sulfides and stringer sulfides, including significant occurrences of sphalerite and galena. This geological setting mirrors that of Kuroko-type VMS deposits known for their rich polymetallic content and significant economic yields, as exemplified by the renowned Kuroko deposits in Japan.

Figure 2: Geology, geophysics, and historical drilling at Havens Steady

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/9885/240423_5213bd8154dc49d4_003full.jpg

Since acquiring the Property in January 2024, Anteros has performed comprehensive digital compilation of the historical exploration data. Compilation confirmed that previous geophysical work, including airborne electromagnetics, identified multiple conductive anomalies consistent with the presence of sulfide mineralization. Additionally, historic drill programs have outlined multiple zones of high-grade lead, zinc, silver, and copper mineralization demonstrated by the presence of sphalerite and galena with bornite and chalcopyrite in copper-rich zones. The known deposit area has a strike length of at least 1,000 metres and historic drilling shows mineralization extending to over 800 metres below surface.

Anteros has now initiated inaugural 3D modeling of the various mineralized horizons within the deposit. This modeling effort will enable precise targeting of higher-grade zones and the extension of known zones, including those enriched with copper and gold. Drill testing is scheduled to commence in late spring/early summer of 2025, and will become part of an inaugural mineral resource estimate.

HISTORIC DRILLING HIGHLIGHTS

Length-weighted intercepts from historical drill holes completed at Havens Steady appear in Table 1.

Table 1: Length-weighted intercepts from historical drilling at Havens Steady

| Drill Hole | From (m) | To (m) | Int. (m) | Cu % | Pb % | Zn % | Ag g/t | Au g/t | ZnEq* |

| HS-87A-86 | 33.10 | 73.60 | 40.50 | 0.01 | 0.68 | 0.81 | 8.40 | 0.07 | 1.74 |

| including | 71.25 | 72.60 | 1.35 | 0.03 | 1.96 | 6.03 | 53.49 | 0.14 | 9.53 |

| HS-87-2 | 9.20 | 68.90 | 59.70 | 0.11 | 0.17 | 0.66 | 8.30 | 0.23 | 2.05 |

| including | 67.30 | 67.60 | 0.30 | 0.04 | 0.70 | 16.30 | 47.8 | 0.07 | 18.67 |

| HS-87-2 | 103.35 | 107.10 | 3.75 | 0.06 | 0.72 | 3.91 | n/a | 0.12 | 4.89 |

| HS-88-01 | 170.00 | 218.60 | 48.60 | 0.01 | 0.19 | 0.50 | 3.70 | 0.07 | 0.97 |

| including | 170.00 | 172.00 | 2.00 | 0.03 | 0.35 | 3.58 | 19.8 | 0.07 | 4.76 |

| HS-88-02 | 62.50 | 64.60 | 2.10 | 0.27 | 1.28 | 4.45 | 30.81 | 0.37 | 8.19 |

| HS-88-03 | 182.00 | 250.00 | 68.00 | 0.09 | 0.55 | 1.45 | 11.80 | 0.20 | 3.04 |

| including | 182.40 | 185.00 | 2.60 | 0.91 | 1.32 | 6.44 | 45.68 | 1.99 | 17.35 |

| including | 191.00 | 192.00 | 1.00 | 0.30 | 3.56 | 5.98 | 32.50 | 0.55 | 11.79 |

| including | 199.70 | 201.00 | 1.30 | 0.20 | 3.56 | 4.52 | 37.80 | 0.27 | 9.39 |

| HS-88-05 | 286.00 | 287.00 | 1.00 | 0.22 | 4.48 | 16.80 | 21.00 | 0.21 | 21.57 |

| HS-88-05 | 298.00 | 395.70 | 97.70 | 0.04 | 0.33 | 1.57 | 9.20 | 0.09 | 2.47 |

| including | 298.00 | 302.00 | 4.00 | 0.30 | 0.74 | 3.62 | 21.38 | 0.14 | 6.17 |

| HS-88-05 | 317.00 | 322.00 | 5.00 | 0.09 | 0.41 | 2.43 | 14.40 | 0.19 | 3.99 |

| HS-88-05 | 332.60 | 337.50 | 4.90 | 0.05 | 0.88 | 3.64 | 22.96 | 0.07 | 5.31 |

| HS-88-05 | 345.40 | 349.40 | 4.00 | 0.01 | 0.49 | 2.97 | 15.00 | 0.07 | 4.01 |

| HS-88-05 | 374.60 | 378.60 | 4.00 | 0.01 | 0.76 | 4.11 | 11.90 | 0.07 | 5.21 |

| HS-88-06 | 108.50 | 109.50 | 1.00 | 0.66 | 0.23 | 6.52 | 28.00 | 0.55 | 11.30 |

| HS-88-06 | 130.00 | 134.00 | 4.00 | 0.03 | 0.67 | 2.23 | 5.53 | 0.07 | 3.12 |

| HS-88-07 | 410.40 | 413.90 | 3.50 | 0.14 | 2.72 | 9.89 | 28.43 | 0.54 | 14.49 |

| HS-88-07 | 457.85 | 460.70 | 2.85 | 0.18 | 1.08 | 7.13 | 33.71 | 0.16 | 9.97 |

| HS-88-07 | 476.70 | 516.70 | 40.00 | 0.01 | 0.26 | 1.07 | 7.60 | 0.08 | 1.75 |

| including | 484.70 | 487.70 | 3.00 | 0.01 | 0.44 | 2.72 | 9.67 | 0.07 | 3.55 |

| HS-88-07 | 504.60 | 511.70 | 7.10 | 0.02 | 0.58 | 2.47 | 16.90 | 0.11 | 3.77 |

| HS90-11 | 573.70 | 575.20 | 1.50 | 0.01 | 0.84 | 3.71 | 15.75 | 0.01 | 4.82 |

| HS09-17 | 68.00 | 89.90 | 21.90 | 0.01 | 0.28 | 1.00 | 6.70 | 0.03 | 1.51 |

| including | 69.00 | 73.70 | 4.70 | 0.01 | 0.61 | 1.69 | 12.89 | 0.04 | 2.64 |

| HS09-18 | 32.25 | 34.25 | 2.00 | 0.02 | 0.42 | 2.11 | 9.02 | 0.03 | 2.82 |

| HS09-18 | 66.30 | 68.30 | 2.00 | 0.10 | 0.21 | 2.26 | 12.65 | 0.11 | 3.45 |

| HS09-18 | 88.31 | 88.81 | 0.50 | 1.19 | 1.57 | 9.70 | 67.50 | 2.72 | 24.46 |

| HS09-18 | 92.30 | 100.14 | 7.84 | 0.86 | 1.68 | 3.64 | 26.22 | 0.86 | 10.78 |

| including | 97.42 | 100.14 | 2.72 | 2.10 | 3.60 | 6.17 | 56.42 | 1.82 | 22.25 |

| HS09-18 | 126.50 | 135.50 | 9.00 | 0.44 | 0.89 | 3.92 | 31.46 | 0.21 | 7.55 |

| HS09-18 | 153.90 | 165.20 | 11.30 | 0.08 | 0.62 | 2.18 | 19.06 | 0.08 | 3.69 |

| including | 158.30 | 161.30 | 3.00 | 0.02 | 1.07 | 3.93 | 24.80 | 0.05 | 5.63 |

| HS09-20 | 92.56 | 103.10 | 10.54 | 0.03 | 0.47 | 1.23 | 16.89 | 0.07 | 2.38 |

| including | 98.06 | 99.75 | 1.69 | 0.14 | 1.82 | 4.01 | 90.39 | 0.22 | 9.25 |

| HS09-20 | 116.30 | 125.55 | 9.25 | 0.11 | 0.63 | 1.76 | 25.25 | 0.04 | 3.47 |

| including | 123.05 | 124.55 | 1.50 | 0.16 | 0.89 | 3.29 | 42.83 | 0.07 | 6.00 |

| HS09-21 | 98.38 | 99.87 | 1.49 | 1.26 | 1.98 | 5.71 | 87.61 | 1.99 | 19.58 |

| HS09-21 | 133.77 | 159.15 | 25.38 | 0.10 | 0.52 | 1.78 | 13.74 | 0.09 | 3.14 |

| including | 142.61 | 146.61 | 4.00 | 0.09 | 1.54 | 3.24 | 27.90 | 0.20 | 5.98 |

*Zinc Equivalent (‘ZnEq’) calculated using US$4.25/lb Cu, $0.8/lb Pb, $1.3/lb Zn, $30/oz Ag, and $2500/oz Au, and assumes 100% recovery

QUALIFIED PERSON

Jesse Halle, P. Geo., an independent Qualified Person in accordance with National Instrument 43-101 – Standards of Disclosure for Mineral Projects, has reviewed the technical material contained in this news release and approves the content of the News Release.

ABOUT Anteros Metals Inc.

Anteros is a multimineral junior mining company using data science to target and acquire highly prospective deposits for exploration and development throughout Newfoundland and Labrador. The Company is currently focused on advancing four key projects across diverse commodities and development horizons. Immediate plans for their flagship Knob Lake Property include bringing the historical Fe-Mn Mineral Resource Estimate into current status as well as commencing baseline environmental and feasibility studies.

For further information please contact or visit:

Email: info@anterosmetals.com | Phone: +1-709-769-1151

Web: www.anterosmetals.com

Social: @anterosmetals

On behalf of the Board of Directors,

Chris Morrison

Director

Email: chris@anterosmetals.com | Phone: +1-709-725-6520

Web: www.anterosmetals.com/contact

16 Forest Road, Suite 200

St. John’s, NL, Canada

A1X 2B9

Cautionary Statement Regarding Forward-Looking Information

This news release may contain ‘forward-looking information’ and ‘forward-looking statements’ within the meaning of applicable Canadian securities legislation. All information contained herein that is not historical in nature may constitute forward-looking information. Forward-looking statements herein include but are not limited to statements relating to the prospects for development of the Company’s mineral properties, and are necessarily based upon a number of assumptions that, while considered reasonable by management, are inherently subject to business, market and economic risks, uncertainties and contingencies that may cause actual results, performance or achievements to be materially different from those expressed or implied by forward looking statements. Except as required by law, the Company disclaims any obligation to update or revise any forward-looking statements. Readers are cautioned not to put undue reliance on these forward-looking statements.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/240423

News Provided by Newsfile via QuoteMedia