How BlackRock’s $1 Billion Bitcoin Investment Could Propel BTC Toward a $2 Trillion Market Cap

Bitcoin price enters a mild 1% on Wednesday April 30, with institutional inflows on the rise, BTC now eyes the $2 trillion market cap milestone.

Bitcoin price breaches $95,000 amid $1B inflows into BlackRock’s Bitcoin ETF

Bitcoin (BTC) surged to a local high of $95,400 on Tuesday April 29, as BlackRock’s iShares Bitcoin Trust (IBIT) recorded a historic $1 billion in daily net inflows. This marks the largest single-day inflow since the ETF’s January launch and reflects unprecedented demand from institutional investors.

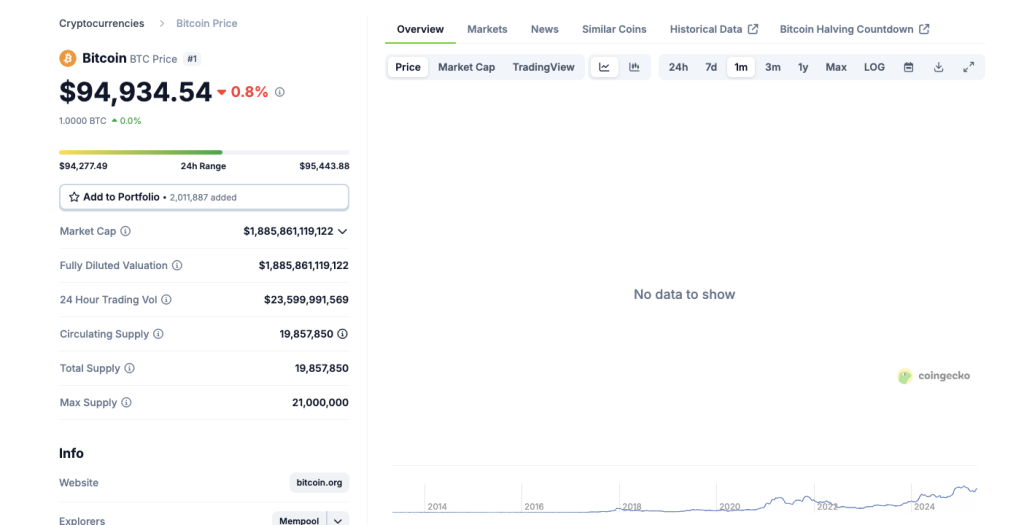

According to data from Coingecko, BTC’s current market capitalization stands just under $1.9 trillion, with many analysts forecasting a breakout past the $2 trillion mark in Q2 if momentum persists.

The inflow into IBIT signals growing investor confidence in Bitcoin’s long-term role as a macro hedge and alternative asset.

Notably, Geoff Kendrick of Standard Chartered reiterated also his $120,000 BTC forecast by Q2 2025, citing expanding institutional adoption and macroeconomic fragility as key drivers. In the long term, he sees the $140,000 mark as attainable if liquidity conditions improve.

BlackRock’s outsized role in institutional onboarding has helped BTC become a core portfolio component across global asset managers. As fund inflows build, market watchers expect more upward pressure on prices heading into the summer.

BTC institutional demand coincides with weak labor data

The crypto market’s bullish tilt aligns with deteriorating macro indicators that could open the door for a potential Fed rate cut. On April 29, the U.S. Labor Department reported that March job openings fell to 7.2 million—well below the expected 7.5 million. This marks one of the lowest readings since 2021.

Simultaneously, the Conference Board’s consumer confidence index dropped for the fifth straight month, hitting its lowest level since January 2021. Historically, such weak US labor data often triggers Fed to intervene with expansionary monetary policies, which tend to favor risk-on assets like Bitcoin.

This pattern could repeat the increased money supply could propel Bitcoin price towards $120,000 as Standard Chartered analyst Geoff Kendrick predicts.

Looking ahead: What’s next for Bitcoin price in Q2 2025

BlackRock’s $1 billion IBIT inflow on Monday may be the clearest signal yet that Bitcoin is maturing into a global institutional asset.

Coupled with weakening U.S. macro data, BTC price could be on the verge a breakout towards the $2 trillion market cap milestone.

With BTC price already trading above $94,000, it needs only a modest 5–6% push to reach the $2 trillion market cap milestone.

Should corporate invest continue pouring capital into Bitcoin ETFs in anticipation of dovish Fed, Bitcoin price is likely to cross the $2 trillion market cap in the coming weeks.

While regulatory risks, and trade policy shocks still remain active, the unusual corporate inflows suggest’s Bitcoin next all-time high breakout could already be underway.

Bitcoin Price Forecast Today: BTC Eyes $98,500 as Corporate Demand Surges

Bitcoin price is consolidating near $94,200 at press time after testing weekly highs at $95,500 following BlackRock’s $1 billion ETF inflow.

Technical indicators on the Bitcoin price forecast shows the upper Bollinger Band at $98,554, acting as short-term resistance.

With BTC price holding well above the midline ($88,979), it reinforces a bullish narrative.

Beyond that, the Relative Strength Index (RSI) at 65.59 suggests bullish momentum without veering into overbought territory, giving BTC room to push higher. A

decisive close above $95,000 could propel price toward $98,500 in the coming sessions, particularly if institutional inflows persist. Conversely, a break below the midline of the Bollinger Band could open a reversion toward $79,400, the lower band.

The post How BlackRock’s $1 Billion Bitcoin Investment Could Propel BTC Toward a $2 Trillion Market Cap appeared first on CoinGape.