VanEck Chief Matthew Sigel Projects How Much Bitcoin Strategic BTC Reserves Could Hold

Matthew Sigel, Head of Digital Asset Research at VanEck, has estimated that Bitcoin strategic reserve bills proposed in multiple U.S. states could lead to the purchase of approximately 247,000 BTC. If enacted, these bills could generate $23 billion in buying pressure, adding a new dimension to state-level financial strategies.

VanEck Chief Matthew Sigel Stance On Bitcoin Strategic BTC Reserves

VanEck Chief Matthew Sigel has shared his analysis on X, stating that 20 state-level Bitcoin strategic reserve bills have been proposed across the United States. If these bills are implemented, states could allocate substantial funds toward Bitcoin purchases.

He noted that the projected $23 billion in buying pressure is based on the collective financial commitments of these states.

“This amount excludes pension fund investments,” Sigel said, suggesting that the overall buying pressure could increase if more states introduce similar reserve bills. The analysis indicates that demand for Bitcoin from state governments could contribute to the market’s liquidity and price movements.

North Carolina and Other States Push for Bitcoin Reserves

North Carolina recently introduced House Bill 92, which would allow the state to allocate up to 10% of certain funds into Bitcoin and other cryptocurrencies. The bill requires that any cryptocurrency included in the reserve must have a market capitalization of at least $750 billion, which ensures that Bitcoin would be the primary asset in the reserve.

State Representative Mark Brody stated that adding Bitcoin to state reserves could provide a hedge against inflation. “With the U.S. dollar facing periods of inflation and devaluation, it is prudent to explore this new breed of assets,” Brody said.

Concurrently, New Mexico has already signaled interest in this direction. Senator Anthony Thornton recently filed the “Strategic Bitcoin Reserve Act,” which could allow the state to purchase up to $2 billion in Bitcoin.

Trump Administration’s Crypto Stockpile Evaluation

While individual states move forward with their Bitcoin reserve proposals, the Trump administration has begun evaluating the possibility of a national cryptocurrency stockpile. Last month, an executive order established a working group to assess the feasibility of holding Bitcoin and other digital assets at the federal level.

The administration has not released specific details on how a national Bitcoin reserve would be structured. However, the growing interest among states suggests that Bitcoin is increasingly viewed as a long-term asset for public funds. Moreover, Donald Trump’s family project has also launched its Macro Strategy reserve, aimed at strengthening its position in the cryptocurrency market.

Amid these expectations, experts have noted that managing a Bitcoin reserve requires specialized knowledge, and some have raised concerns about government experience in handling digital assets.

Bitcoin Price Trend Amid Accumulations

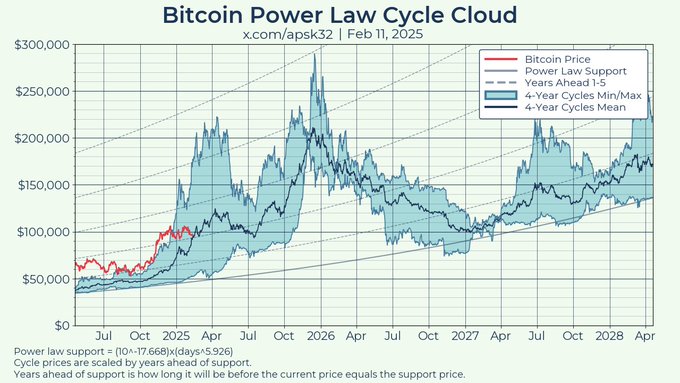

Analysts have been monitoring Bitcoin’s price cycles, noting that previous market peaks occurred every four years. The last three highs were recorded in November 2021, December 2017, and November 2013. If this pattern continues, analysts expect the next peak to occur between November and December 2025.

Some experts reference the power law model, which suggests Bitcoin follows a long-term exponential growth trend.

Based on this model, potential price peaks in the current cycle could range from $190,000 to $290,000. Analysts argue that Bitcoin’s price movements have remained within expected patterns despite short-term fluctuations.

The post VanEck Chief Matthew Sigel Projects How Much Bitcoin Strategic BTC Reserves Could Hold appeared first on CoinGape.