Will the Stock Market’s Santa Rally Bring Holiday Cheer to Investors?

A smart investor listens to the stock market and this week’s stock market action was a perfect example of why this is important.

It was a roller-coaster week in the stock markets leading many investors to quickly sell holdings when there was a big selloff and scramble to go long again on Friday when the broader stock market indexes turned higher. This is why it’s a good idea to always look at a longer time frame chart to get a sense of the long-term trend before making hasty decisions.

If you pull up a weekly chart of any of the three major indexes you’ll see that the S&P 500 ($SPX) and Nasdaq Composite ($COMPQ) are trending higher. The Dow Jones Industrial Average ($INDU) is also doing the same but it’s just hanging in there by a whisker.

The Ups and Downs

Comments from Fed Chairman Jerome Powell on Wednesday sent investors into selloff mode which spilled over into Thursday. But Friday’s slightly lighter-than-expected November PCE may have reversed investor sentiment. The broader stock market indexes moved higher spreading some holiday cheer to an otherwise gloomy week.

What made the market move higher? It doesn’t make sense to look for a reason for the reversal in sentiment. Remember, it’s best to listen to the market and follow along. That said, a few interesting data points are worth noting.

The Federal Reserve indicated their focus was on a cooling of the labor market in their last few meetings. However, Wednesday’s comments from Chairman Powell suggested that the labor market is doing fine now but the Fed’s focus has switched to inflation. That may have made investors nervous and triggered the massive selling we witnessed on Wednesday. Friday’s light November PCE may have been a sigh of relief that brought back the optimistic sentiment.

Despite the optimistic sentiment, one important news we can’t lose sight of is the possibility of a US government shutdown. A shutdown doesn’t necessarily impact the stock market but there may be inconveniences such as a reduction in government services that may send ripples through the economy.

The Year-End Party

As 2024 winds down, there will likely be very light trading days but there are some important events that unfold at the end of the year. There’s the January Effect which is when small-cap stocks start rallying. Small-cap stocks got a boost post US election but since late November they’ve been sliding lower. The daily chart of iShares Russell 2000 ETF (IWM) shows the small-cap trend is still bearish.

FIGURE 1. DAILY CHART OF IWM. Small cap stocks took a big hit in December. Look for the full stochastic oscillator to cross above the 20 level with some follow-through to confirm their seasonal rally. Chart source: StockCharts.com. For educational purposes.

The full stochastic oscillator is deep in oversold territory and a cross above the 20 level would be encouraging for small-cap stocks. But there needs to be follow-through for the small caps to have a bullish rally.

In addition to the January Effect, there’s the eagerly awaited Santa Claus rally, which is supposed to start next week. Friday’s price action may have reignited the possibility of having Santa show up this year. But I wouldn’t hold my breath just yet.

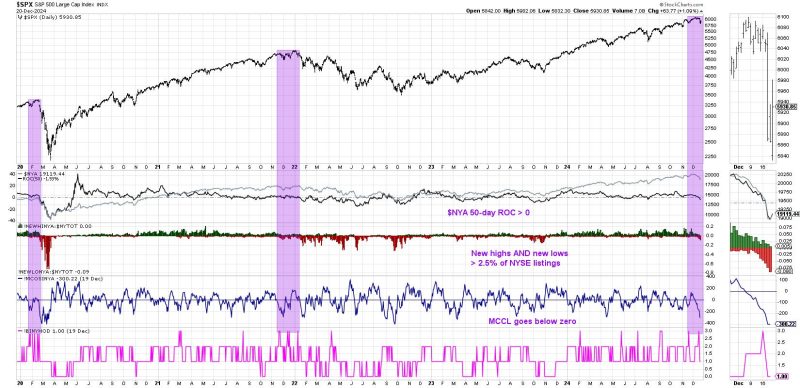

If you look at the daily chart of the S&P 500 below, you’ll see that the three market breadth indicators displayed in the lower panels had started declining in late November, which should have signaled that the market was ripe for a selloff.

FIGURE 2. S&P 500 HOLDS ON TO SUPPORT. Friday’s price action may look slightly bullish but it needs more follow-through to confirm a reversal. Chart source: StockCharts.com. For educational purposes.

What is concerning is that Friday’s price action didn’t change the market breadth narrative. So even though Friday’s rise was sizeable, with a bullish engulfing pattern that closed at the 50-day simple moving average, I wouldn’t rush to buy the dip just yet and certainly not on triple-witching Friday. For all you know, there could have been some short-covering going on. I’ll need to see more follow-through of the upside move before adding more positions to my portfolio. At least the S&P 500 stayed above the support of its mid-November lows.

The daily chart of the S&P 500 Equal Weighted Index ($SPXEW) vs. the S&P 500 gives you an idea of how dominant the heavily weighted stocks influence the index.

FIGURE 3: S&P 500 VS S&P 500 EQUAL-WEIGHTED INDEX. The less-heavy weighted stocks in the S&P 500 are lagging the S&P 500. The equal-weighted index is trading below its 100-day moving average and has a long way to go before re-establishing its uptrend. Chart source: StockCharts.com. For educational purposes.

$SPXEW is trading below its 100-day SMA. Note that Friday’s high came close to the 100-day SMA. A close above the 100-day SMA would be the first sign of a trend reversal in the equal-weighted index. But one day’s action doesn’t make a trend. A series of higher highs and higher lows needs to be established before a trend has indeed reversed. It would be more confirming if the non-Mag Seven stocks showed signs of catching up with the big S&P 500 index.

Volatility Pulls Back

One encouraging point to end the week is the Cboe Volatility Index ($VIX) closed below 20 (see chart below). Investors were getting so complacent towards the end of November but if you had noticed the VIX creeping higher, you’d have seen the selloff coming.

FIGURE 4. DAILY CHART OF THE CBOE VOLATILITY INDEX ($VIX). The VIX was at very low levels from November but it slowly started moving higher signaling that investors were getting fearful. This led to Wednesday’s spike. Chart source: StockCharts.com. For educational purposes.

The pattern in the chart of the VIX shows that a similar pattern occurred from June to July, right before the August spike. Could a similar scenario unfold this time?

The Mark Twain quote, “History doesn’t repeat itself but it often rhymes,” explains it so well. So as you navigate the stock market, listen to the rhythm and follow its lead.

The bottom line: Set up your Dashboard panels on the StockCharts platform and get a bird’s eye view of the stock market.

End-of-Week Wrap-Up

- S&P 500 down 1.99% for the week, at 5930.85, Dow Jones Industrial Average down 2.25% for the week at 42,840.26; Nasdaq Composite down 1.78% for the week at 19,572.60

- $VIX up 32.95% for the week, closing at 18.36.

- Best performing sector for the week: Technology

- Worst performing sector for the week: Energy

- Top 5 Large Cap SCTR stocks: Applovin Corp. (APP); Palantir Technologies (PLTR); Reddit Inc. (RDDT); Astera Labs, Inc. (ALAB); MicroStrategy Inc. (MSTR)

On the Radar Next Week

- November Durable Goods Orders

- November New Home Sales

- October S&P/Case-Shiller Home Prices

Disclaimer: This blog is for educational purposes only and should not be construed as financial advice. The ideas and strategies should never be used without first assessing your own personal and financial situation, or without consulting a financial professional.