Killing of UnitedHealthcare CEO prompts flurry of stories on social media over denied insurance claims

The early morning killing of a top health insurance executive in midtown Manhattan Wednesday has unleashed a flurry of rage and frustration from social media users over denials of their medical claims, a public display of Americans’ pent-up anger at the nation’s complex health insurance industry.

In one stark example, a Facebook post by UnitedHealth Group expressing sadness about UnitedHealthcare CEO Brian Thompson’s death received 62,000 reactions – 57,000 of them laughing emojis. UnitedHealth Group is the parent company of UnitedHealthcare, the division that Thompson ran.

New York police have yet to determine the shooter’s identity and motive, but in an interview with NBC, Thompson’s widow, Paulette, told the network that “there had been some threats” against her husband, potentially related to “a lack of coverage… I don’t know the details.”

A shell casing recovered from two of the bullets at the scene of the shooting had the words “depose” and “delay” written on them, according to law enforcement sources. Police are exploring whether the words indicate a motive since they are similar to the title of a book that’s critical of the broader insurance industry – “Delay Deny Defend.”

The majority of insured US adults had at least one issue, including denial of claims, with their health insurance in the span of a year, according to a survey released in June 2023 by KFF, a nonprofit health policy research group.

“Limitations on access to care due to claims denials have absolutely been a source of frustration for a long time,” said Kaye Pestaina, KFF’s director of Program on Patient and Consumer Protections.

A major industry group for health insurers criticized some of the social media reactions.

“The people in our industry are mission-driven professionals working to make coverage and care as affordable as possible and to help people navigate the complex medical system,” Mike Tuffin, CEO of the trade association, AHIP, said in a statement. “We condemn any suggestion that threats against our colleagues – or anyone else in our country – are ever acceptable.”

“We, at UnitedHealth Group, will continue to be there for those who depend upon us for their health care,” the statement said. Other insurers did not return requests for comment.

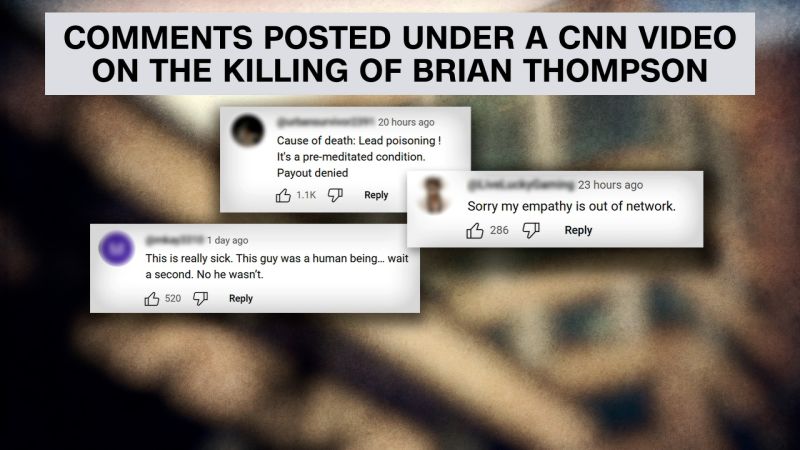

Social media backlash

Almost immediately after news broke that Thompson had been killed, social media users began posting about their frustrations with UnitedHealthcare and other insurance companies.

UnitedHealthcare “denied my surgery two days before it was scheduled. I was in the hospital finance office in tears (when I was supposed to be at the hospital doing pre-op stuff),” one user wrote in an X post that received more than 70,000 likes. “My mother was flying out to see me. My surgeon spent a day and a half pleading my case to United when she probably should have been taking care of her other patients,” she added, before saying the surgery ended up going ahead but calling the process “torture.”

“My breast cancer surgery was denied” by a different insurance company, another X user posted. “Breast cancer. She asked me ‘well, is it an emergency?’ I don’t know- it’s (f***ing) cancer. What do you think? I had to appeal and luckily it went through. Evil to do that to people,” she said.

TikTokker and anesthesiologist Brian Schmutzler said in a video that the shooting was “obviously tragic for him, tragic for his family, but this brought up some bigger issues.”

“From my perspective, we have a bigger issue with the insurance companies in general, who, essentially, it’s their job to make money, not to actually pay for health care,” he said.

In a blog post Thursday entitled “Why ‘we’ want insurance executives dead,” journalist Taylor Lorenz, who covers social media, analyzed the online responses: “No, that does not mean people should murder them. But if you’ve watched a loved one suffer and die from insurance denial, it’s normal to wish the people responsible would suffer the same fate.”

Lorenz’s post sparked a wave of backlash online.

Frightening denials

It’s not uncommon for Americans and their doctors to go through multiple hoops to get approval for the care doctors say their patients need, or to combat denials from carriers.

Nearly one in five insured adults experienced claim denials during a 12-month period, according to KFF’s 2023 survey. Those with job-based insurance or Affordable Care Act policies ran into this problem about twice as often as those covered by Medicare or Medicaid, whose denial rates were around one in 10.

Restricting access to health care through tools like claim denials and prior authorization, which requires that insurers approve the care in advance, are among the ways that health insurers try to weed out care that’s not medically necessary or not backed by scientific evidence – but it can also increase their profit margins. The practices, which increasingly rely on technology, including artificial intelligence, can infuriate patients and providers alike.

A class action lawsuit filed last year in US District Court in Minnesota argued that UnitedHealthcare uses AI “in place of real medical professionals to wrongfully deny elderly patients care,” according to the complaint. More than 90% of the denials are reversed through an internal appeal or proceedings before federal administrative law judges, the suit alleges.

UnitedHealthcare asked the court to dismiss the lawsuit, claiming the plaintiffs must first exhaust the administrative appeal process set by the Medicare Act, among other reasons.

The denial of claims can lead to major problems for patients, both in terms of care and their finances.

Last year, UnitedHealthcare settled a case brought by a severely ill college student in Pennsylvania who claimed the company denied coverage for drugs determined necessary by his doctors, leaving him with a medical bill of more than $800,000. The lawsuit, which was chronicled by ProPublica, uncovered the lengths to which the insurer goes to reject claims, including burying medical reports and relying on rubberstamped recommendations from doctors paid by the company.

Roughly a quarter of consumers whose claims insurance companies denied experienced significant delays in getting medical care or treatment, and about the same share were unable to receive care, the KFF survey found. About a quarter of those said their health declined.

Having to postpone care because of coverage denials can also affect patients’ mental health. Some 80% of adults said they or a family member were worried or anxious about delays in care, according to a 2023 Commonwealth Fund survey of adults ages 19 to 64.

Relatively few people try to fight when their insurer turns down their claim. Only 43% of adults in the Commonwealth Fund survey said they or their doctor challenged an insurer’s denial of claim. Some 45% of respondents said they weren’t sure they had the right to appeal the denial, while 40% said they weren’t sure whom to contact. Nearly a quarter said they didn’t have the time.

But challenging the denial can produce results. Half of those who appealed ultimately had their care approved, the Commonwealth Fund survey found.

Inappropriate denials in Medicare Advantage

Inappropriate denials of services and payments by Medicare Advantage insurers – including UnitedHealthcare, the largest player in the swiftly growing market – have come under fire in recent years, particularly from the Department of Health and Human Services, which regulates the program, and from some lawmakers.

The insurers, which are paid by the federal government to provide Medicare services to enrollees, have at times delayed or denied beneficiaries’ access to medical care – even though the requests met Medicare coverage rules, according to a 2022 report from HHS’ inspector general’s office. Annual federal audits have highlighted “widespread and persistent problems related to inappropriate denials of services and payment,” the office said.

A central concern is the potential incentive Medicare Advantage plans have to deny access to services and payments to providers in an attempt to increase profits, the office said. Insurers are given a set amount of money per patient regardless of the amount of care received.

UnitedHealthcare, in particular, has come under public scrutiny as it dramatically increased care denials for its Medicare Advantage enrollees.

The insurer more than doubled the rate of denials for care following hospital stays between 2020 and 2022 as it implemented machine-assisted technology to automate the process, according to a Senate Permanent Subcommittee on Investigation’s report released in October. That far surpassed its competitors, including Humana, whose care denials grew 54% during the same time period.

“Despite alarm and criticism in recent years about abuses and excesses, insurers have continued to deny care to vulnerable seniors—simply to make more money,” Connecticut Sen. Richard Blumenthal, who chairs the subcommittee, said in a statement in October.