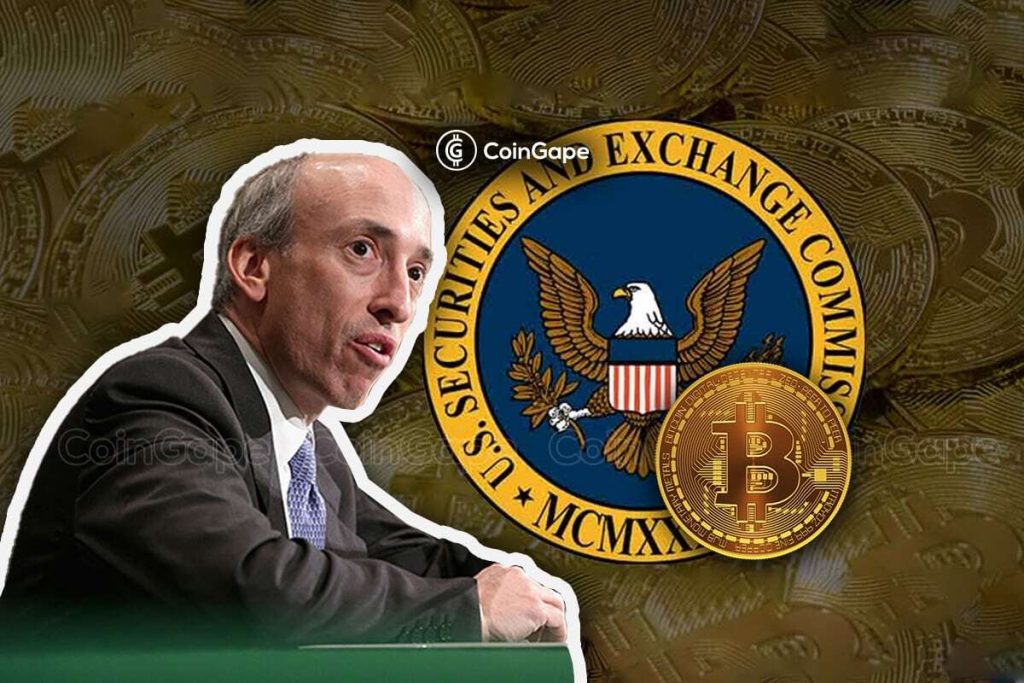

Donald Trump May Not Be Able To Fire Gary Gensler, Here’s Why

As the U.S. braces for potential changes following today’s election, the future of SEC Chair Gary Gensler has sparked debate. With the possibility of a Donald Trump or Harris administration, some speculate about shifts in agency leadership. However, crypto lawyer Dave Michaels recently highlighted legal nuances that may shield Gensler from immediate removal.

Michaels referenced existing legal precedents that outline specific protections for heads of independent agencies like the SEC. He suggested that dismissing Gary Gensler could prove challenging.

Donald Trump or Harris May Not Have Authority to Dismiss Gary Gensler

In a social media post, Michaels addressed the question of whether a change in the presidency would allow Donald Trump or Harris to remove Gary Gensler from his role as SEC Chair. He pointed out that the Supreme Court’s 1935 decision in Humphrey’s Executor v. United States protects independent agency heads, such as FTC commissioners, from removal based solely on executive preference.

This ruling, although it directly addresses the FTC, has parallels that are often interpreted to apply to the SEC as well. This interpretation is based on the SEC’s similar operational independence and regulatory oversight functions.

The legal precedent implies that independent agency leaders like Gary Gensler are not easily removable without cause. This protection was designed to insulate heads of regulatory bodies from political influence and executive changes. Therefore, even if Donald Trump were to take office, the statute does not grant direct authority to dismiss an SEC Chair simply to install a preferred candidate.

Michaels emphasized that this complex legal framework means any attempt to remove Gary Gensler without documented reasons could result in prolonged legal disputes.

The legal expert emphasized,

“A 1935 Supreme Court case (Humphrey’s Executor) protected an FTC commissioner from presidential removal. It didn’t address the SEC, but the way the two commissions work and their independence from the executive branch is similar.”

However, he pointed out that historically, SEC Chairs often resign when an opposing political party gains power, allowing the new administration to select an aligned successor. Michaels noted that this practice might influence Gary Gensler’s decision should there be a shift in leadership.

This form of voluntary resignation could enable a smooth transition, preserving the SEC’s regulatory continuity. Concurrently, the possibility aligns with MetaLawMan’s prediction of Gensler’s possible resignation if Trump wins.

Nonetheless, if Gary Gensler chooses not to resign, Donald Trump would face limited options, possibly relying on indirect measures such as reassigning responsibilities within the SEC.

Ripple Effect on SEC’s Enforcement Policies

Any potential change in SEC leadership could impact the regulatory approach to cryptocurrency. Under Gary Gensler, crypto firms’ compliance costs have exceeded $400 million due to intensified SEC enforcement actions. The aggressive regulatory stance has faced industry criticism.

Most recently, former SEC official Marc Fagel criticized the agency’s sudden issuance of a Wells Notice to Immutable, an Ethereum-based gaming firm. He described the SEC’s abrupt approach as “risky,” noting that typically, companies receive extensive communication before such notices. Similarly, Consensys cited SEC scrutiny among factors leading to a 20% workforce reduction.

Meanwhile, the crypto community has speculated that Donald Trump could bring in Robinhood CLO Dan Gallagher to reshape the SEC’s approach to digital assets. Many believe his leadership could foster clearer regulatory guidelines and promote innovation in the crypto sector.

The post Donald Trump May Not Be Able To Fire Gary Gensler, Here’s Why appeared first on CoinGape.