Cobalt Market Update: Q3 2024 in Review

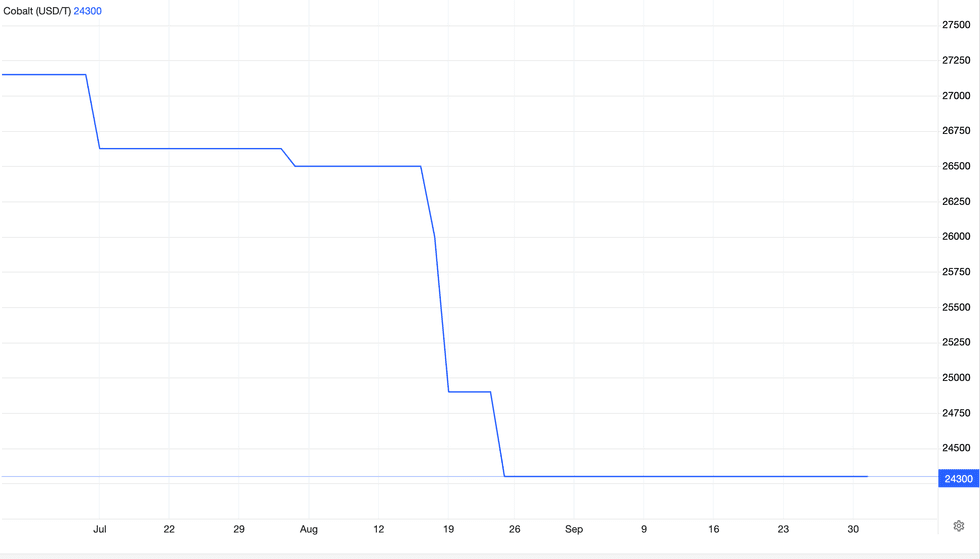

A contraction continued in the cobalt market during the year’s third quarter, with metal values falling from US$27,151.50 per metric ton (MT) on July 1 to US$24,299 by the end of September.

The 10 percent decline is part of a larger 16.56 percent year-to-date contraction.

“This quarter saw minimal pricing movements as the market experienced a prolonged period of low prices,” said Roman Aubry, cobalt pricing analyst at Benchmark Mineral Intelligence.

He went on to note that during the third quarter, all of the cobalt grades Benchmark follows sank to their lowest levels since the company began tracking prices for the battery metal in 2017.

Cobalt metal price chart, Q3 2024.

Chart via Trading Economics.

“Prices for cobalt metal approached US$10 per pound, and cobalt hydroxide, a feedstock for cobalt metal and battery chemicals, approached US$6 per pound due to weak buyer interest and bearish market outlook,” he said.

“Cobalt sulfate prices had initially held a floor of RMB 27,500 per MT (US$3,857.23),’ continued Aubry.

‘However, as the quarter came to an end, cheap recycled cobalt sulfate in China undercut prices from the virgin market and has led to a further decrease in prices.”

Cobalt demand in the doldrums

The cobalt price pressure seen during the third quarter was largely due to a combination of oversupply and weakening demand, particularly from the electric vehicle (EV) battery sector.

The market is grappling with the effects of cobalt’s diminishing role in battery chemistries as manufacturers increasingly turn to lithium-iron-phosphate (LFP) batteries, which contain no cobalt, or opt for nickel-based alternatives with lower cobalt content. This shift has been fueled by efforts to mitigate the environmental and ethical issues associated with cobalt mining in the Democratic Republic of Congo (DRC), the largest cobalt-producing nation.

Additionally, as cobalt production capacity expands in countries like Australia and Angola, oversupply pressures are expected to persist, keeping prices relatively low in the near term.

Industry experts predict that unless there is a significant surge in demand from emerging technologies or battery innovations, cobalt prices will remain suppressed, reflecting a structural change in market dynamics.

“The supply of cobalt has proven to exceed what the market has been able to absorb, and weak buyer interest and full stocks have led to prices being incapable of recovering,” noted Aubry. “Overall, a bearish market is expected through 2025 as participants speculate on what is the lowest price cobalt can fall to.”

Swelling cobalt supply prevents price growth

For Project Blue’s Jack Bedder, the most prevalent trend weighing on the cobalt market in Q3 was oversupply.

“(London Metal Exchange) off-warrant stockpiled cobalt metal has been rising, and trade data indicated an increase in China’s cobalt metal exports to the European market,’ the expert added.

Bedder, who is the co-founder and director of the critical metals consultancy, also pointed to higher output in the DRC and Indonesia as a headwind to cobalt price growth.

“Oversupply of cobalt intermediate continues, underpinned by increased production from the DRC’s cobalt hydroxide and Indonesian Ni-Co MHP (nickel-cobalt mixed hydroxide precipitate),” he said.

While Bedder explained that declining prices have caused companies to reschedule production plans and reduce their production guidance, there is still promise on the development side.

In mid-August, Electra Battery Materials (TSXV:ELBM,NASDAQ:ELBM) received a US$20 million grant from the US Department of Defense to support its cobalt refinery project in Ontario, which it says is set to be North America’s first producer of battery-grade cobalt sulfate. Located in Temiskaming Shores, the C$250 million facility aims to strengthen the EV supply chain and reduce US reliance on foreign sources for critical minerals.

The funding aligns with the US’ strategy of securing essential minerals for defense and technology sectors.

Less than a month later, the company garnered another funding infusion.

“Electra received ample financial backing from the US government to develop its cobalt sulfate refinery in Canada,” said Bedder. “The company has received a total of US$40 million in Q3 2024.”

Electra’s Department of Defense funding wasn’t the only news on the development side.

In late June, Nth Cycle commissioned a 21,000 square foot facility designed to refine metal scrap, e-waste and refinery waste into high-purity critical metals like nickel and cobalt.

US and Canada boost EV tariffs

In addition to building domestic cobalt mining and refining capacity, the US and Canada are working to reduce purchases of Chinese EVs. Both countries have implemented steep tariffs on EVs originating in China.

At the end of August, the Canadian government levied a 100 percent tariff on Chinese EVs. The heightened tariff followed a similar announcement out of the US in May. America also added smaller tariffs on strategic goods necessary for EV production, such as solar cells, semiconductors and lithium batteries.

While the spirit of the new EV taxes aims to spur on domestic production and EV sales, both Aubry and Bedder said they don’t see the tariffs supporting cobalt price growth.

“It is unlikely to have any effect in the short term, as Chinese EVs still remain much cheaper than their western counterparts, even with the tariffs in place, so there is limited incentive for North American producers to build domestic capacity as they are not cost competitive,” said Aubry.

China adds to cobalt-refining capacity

As North America looks to bolster ex-China supply, the Asian nation continues to build its cobalt presence.

“In August, GEM (SZSE:002340) commenced commercial production of a 10,000 MT per year refinery in Hubei province, China. The refinery will be using recycled material to produce standard-grade cobalt metal 99.8 percent,” Bedder said.

He also noted that Tengyuan Cobalt (SZSE:301219) has announced plans to build a new nickel-cobalt refinery in Ganzhou province, China. Commercial production is planned for the fourth quarter of 2025.

“Last year, the company produced 15,400 MT of cobalt metal after completing expansions in December 2022,” he said.

Some of that increased output could be earmarked for China’s strategic cobalt reserve. In late May, reports surfaced that the country’s State Reserve Bureau planned on purchasing 15,000 MT from domestic producers.

“Although this purchase was significantly bigger than previous years, the increased tonnage of the purchase is largely believed to have been a measure taken by the Chinese State Reserve Bureau to offset the significant ramp up in Chinese cobalt metal production capacity,” he said. “As a result, it did not have the strengthening effect that many hoped it would, as Chinese metal production still exceeds what the market is able to absorb.”

What factors will move the cobalt market in 2024?

Benchmark’s Aubry advised monitoring cobalt contracting.

“The price floor for cobalt hydroxide is currently set due to long-term contracts that are set to expire early in 2025, and as a result we may see further price erosion moving into next year,” he said.

While he cautioned that the supply/demand story is still very weak moving forward, he noted that cobalt’s future is heavily correlated to copper. “If prices come off further, we may see margins squeezed due to an increasing oversupply next year,” he said. “If the copper market stays strong, producers in the DRC will be incentivized to continue mining copper and cobalt, even if the price of cobalt hydroxide declines below US$6 per pound.”

Moving into to 2025, Bedder is tracking cobalt stockpiling from China’s State Reserve Bureau.

High quantities of Chinese cobalt flowing into European markets, coinciding with existing London Metal Exchange warehouse inventories, is another development he is monitoring.

Elsewhere, Bedder noted the ongoing dispute between Glencore (LSE:GLEN,OTC Pink:GLCNF) and the DRC government.

“Much like the situation with CMOC Group (OTC Pink:CMCLF,SZSE:603993) in 2022, the DRC government has alleged that Glencore’s subsidiary, Kamoto Copper, owes the state 800 million euros (US$894 million) related to royalty payments,” said Bedder. “As we approach Q4 and 2025, we are eager to see how this might impact cobalt prices, particularly if significant evidence supports the claim. Notably, this also comes after Glencore’s recent decision to halt cobalt hydroxide stockpiling in the DRC.”

Securities Disclosure: I, Georgia Williams, hold no direct investment interest in any company mentioned in this article.