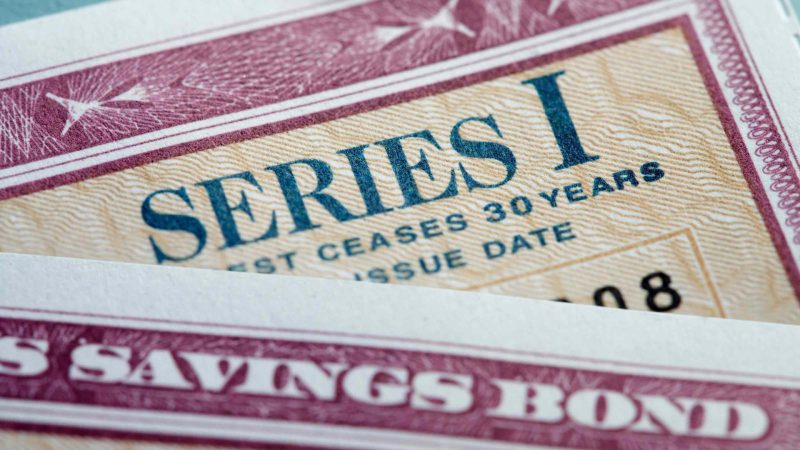

What Are I-Bonds? Inflation Made Them Popular. What Now?

Patriot EE-series savings bonds

Series I savings bonds have drawn a lot of attention over the last few years as inflation flew. Back in 2022, billions of dollars of I-bonds were sold when their interest rate ran up to 9.62%.

As inflation has slowed, so, too, have returns on I-bonds. The current rate on I-bonds is just 3.11%, putting it under some of the best high-yield savings accounts, but I-bonds are still seen as attractive investment measures for certain situations.

Here, we’ve compiled answers to frequently asked questions about I-bonds.

How is the interest rate for I-bonds determined?

The composite rate has two parts: a fixed rate, which remains the same for the life of the bond, and an inflation rate, which is based on the consumer price index.

Each May 1 and November 1, the U.S. Treasury Department announces a new fixed rate and inflation rate that apply to bonds issued during the following six months. The inflation rate changes every six months from the bond’s issue date.

If your bond is issued in November 2024, for example, the current inflation rate will apply through October 2024. The fixed rate for I-bonds issued from November 2024 through April 2025 is 1.20% — and that will never change for as long as you hold the bond (I bonds mature after 30 years).

How does interest accrue on I-bonds?

The bond earns interest monthly from the first day of the month of the issue date, and interest is compounded semiannually. Interest is added to the bond’s principal value.

You can’t redeem an I-bond in the first year, and if you cash it in before five years have passed, you forfeit the most recent three months of interest. If you check your bond’s value at TreasuryDirect.gov within the first five years of owning it, the amount you’ll see will have the three-month penalty subtracted from it.

Consequently, when you buy a new bond, interest does not show until the first day of the fourth month following the issue month. If your bond has a July 2024 issue date, for example, interest is first posted in November 2024.

How much in I-bonds can I buy?

An individual can buy up to $10,000 per calendar year in electronic bonds through TreasuryDirect.gov. You can also buy up to another $5,000 each year with your tax refund (so for those who are married filing jointly, the limit is $5,000 per couple). These will be issued on paper.

You can even designate a beneficiary or co-owner through this program, which you can read more about from the IRS. So, crank up that withholding at work or plan on putting in some extra money to the IRS when you file next year — basically, prefunding your bond purchase.

However, this option is ending at the end of 2024. Buying paper I-bonds with your income tax refund won’t be possible from January 1, 2025. Tax filers will still be able to buy I-bonds online.

That’s just for the individual, though. A range of other entities can purchase I-bonds, including:

Can I buy I-bonds for my kids?

Yes. A parent or guardian can set up a custodial TreasuryDirect account for a child younger than 18. You can purchase I-bonds for your child within the minor account, which you must link to your own TreasuryDirect account.

Other people can send I-bonds as gifts to your child’s account, but you will have to supply your child’s Social Security number and TreasuryDirect account number to the giver. As with an adult, the purchase limit for a child — including gifts received —

is $10,000 per calendar year for electronic I-bonds.

How are I-bonds taxed?

I-bond interest is free of state and local income tax, and you can defer federal tax until you file a tax return for the year you cash in the bond or it stops earning interest because it has reached final maturity (after 30 years), whichever comes first. You can also report the interest every year, which may be a smart choice if you’d rather avoid one large tax bill years down the road.

If you use I-bond proceeds to pay for certain higher-education expenses for yourself, your spouse or your dependents, you may avoid federal tax. But you must meet several requirements to be eligible. Among them, the bond owner must have been at least 24 years old by the issue date and have income that falls below specified limits. See more detail in Taxes on I-Bonds in 10 Common Situations.

How do I navigate TreasuryDirect?

TreasuryDirect has been widely criticized for its unwieldy format for years. Although the home page was updated last year, when it comes to actually using the tools to buy bonds or otherwise interact, it’s back to the old system. And the old system has been described as a time portal back to MySpace.

What can you do?

To buy a savings bond in TreasuryDirect:

I opened a TreasuryDirect account years ago and have lost my account number. What do I do?

Go to this TreasuryDirect page and fill in your personal information. It must match exactly what TreasuryDirect has on file — so if you have moved, for example, you may have to list a previous address.

If the information matches, you’ll answer three security questions. If you respond successfully, you’ll receive an e-mail with your account number.

I’m having trouble buying or managing bonds with the TreasuryDirect website. How can I get help?

You can call TreasuryDirect at 844-284-2676. If the number of callers in the queue becomes too great, an automated message may notify you that TreasuryDirect is no longer accepting calls for the day.

You can reach TreasuryDirect by email by filling out a form on its “contact us” page.